Over the past three decades, there has been a dramatic change in young adults’ living arrangements, with fewer forming their own households and more living with their parents or with roommates. These trends, fueled by economic and affordability constraints, have limited young adults’ ability to buy homes.

In recent years, that has changed slightly; after young adults’ homeownership rate declined from 45.0 percent in 1990 to 37.0 percent in 2015, it increased to 41.6 percent in 2021. But once we adjust for changes in living arrangements, we find that the “real” homeownership gap between today’s young adults and those of 20 years ago is more than three times higher than the measure of the traditional homeownership rate shows. A couple of trends are driving the gap.

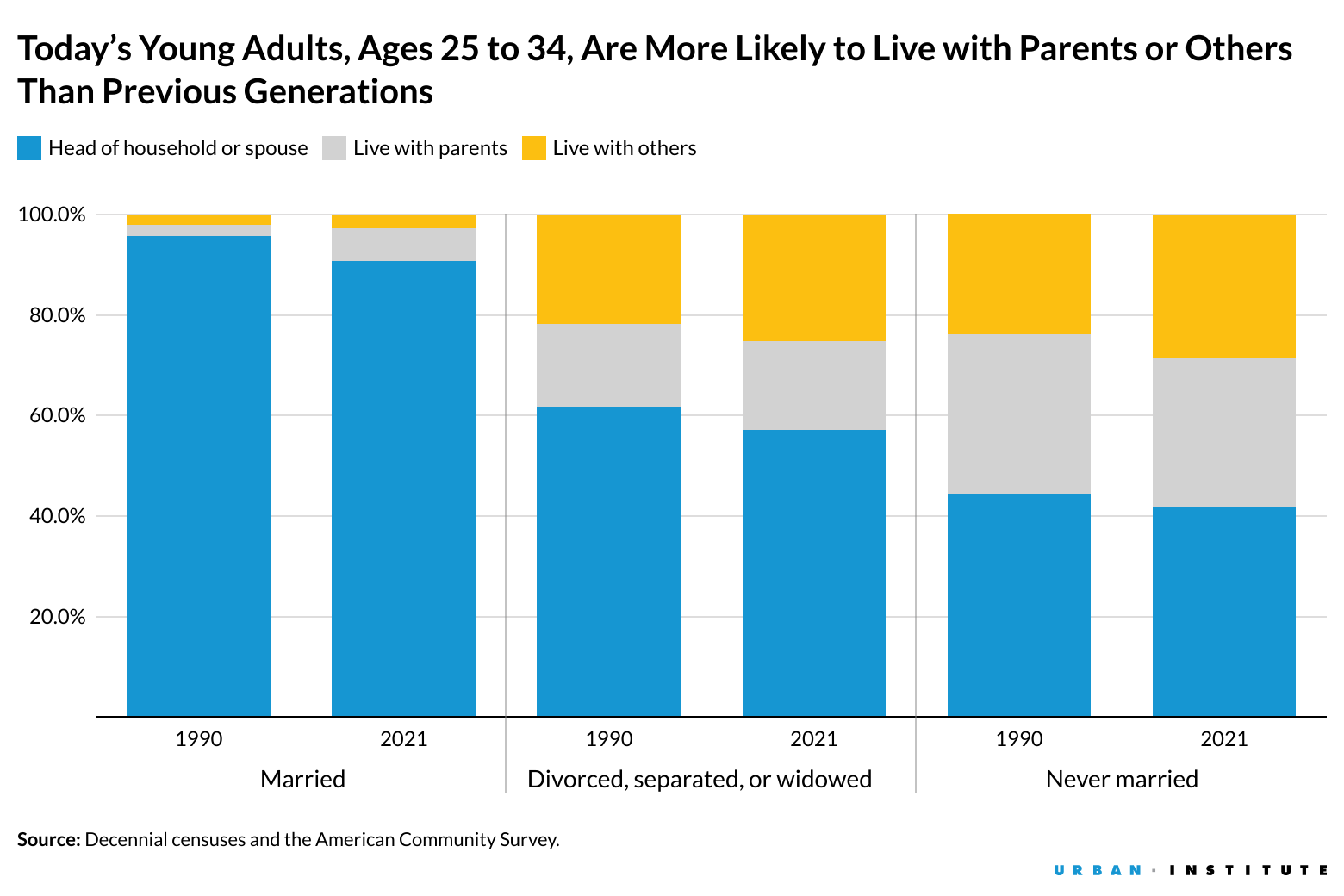

More young adults live with parents and others, delaying household formation

Let’s consider four types of living arrangements: living independently (as a one-person households) or as the household head with other individuals in a household, living as the spouse of the household head, living with parents, and living with others (e.g., relatives or roommates). Only the first type of living arrangement, the head-of-household category, would be considered as the denominator for the traditional homeownership rate calculation (homeowners as a share of total US households, including renters).

If we combine the first type (household head) and the second type (spouse of the household head), we can see a 15.4 percentage-point decline between 1990 and 2021.

This difference stems largely from increases in the share of young adults living with parents (from 12.5 percent to 20.2 percent) and those living with others (from 10.7 percent to 18.3 percent). Additionally, although the current homeownership rate is similar to that of 2010 and well above the 2015 lows, the share of 25-to-34-year-olds living independently has barely budged since 2015.

Lower marriage rates and fewer independent young adults are limiting new household formation

The failure to form households within the census’s definition also correlates with the large decline in the married population share. The share of married young adults has declined from 59.4 percent in 1990 to 38.6 percent in 2021. The census data do not distinguish between nonmarried partners, friends, and visitors. If all those people are added to the married population, providing a considerable overestimate, the pattern is the same: the share would decline from 64 percent to 49 percent. The never-married share has increased from 29 percent in 1990 to 56.1 percent in 2021.

Controlling for marital status, we also find that young adults’ homeownership rates are slightly higher now compared with 1990. This suggests that if today’s young adults had a marriage rate similar to those of prior generations, their homeownership rate would be substantially higher than the current rate.

Young adults’ living arrangements are different today than in 1990. Controlling for marital status (married; divorced, separated, or widowed; or never married), today’s young adults are more likely to live with their parents or live with others than form independent households as head or spouse of the head. But the difference in the share of independent households between 1990 and 2021 is less than 5 percentage points for each of the three marital groups, compared with a 15.4 percentage-point drop among the three groups combined.

It is possible that the rise of cohabitation without marriage is distorting these numbers, but the distortion is likely small; the share of the never-married category that is living with others increased from 24 percent in 1990 to 28.4 percent in 2021. Though the 4.4 percentage-point increase does not have a large effect on our results, and not all the growth among those living with others is attributable to cohabitation in lieu of marriage, the growing share of this population warrants future research on how cohabitation affects housing choices.

What is the real young adult homeownership rate, and how much has it changed?

If we calculate the homeownership rate at the individual level instead of the household level (we call this the “real” homeownership rate), the picture would be very different.

The individual-level homeownership rate calculation allows us to incorporate changes in household formation. Let’s compare the household-based traditional homeownership rate with the individual-based real homeownership rate. We found 41.5 percent of young adults were homeowners as heads or spouses. This share dropped to 29.3 percent in 2021. During this period, the traditional homeownership rate, measured at the household level, dropped from 45.0 percent to 41.6 percent. This means the decline in the real homeownership rate is 12.2 percentage points, compared with a 3.4 percentage-point drop in the traditional homeownership rate.

If we isolate the effects of delayed household formation proxied by changes in marital composition (i.e., we assume the marriage rate was the same as in 1990), we find the hypothetical real homeownership rate would have been 39.1 percent, 9.8 percentage points higher than current levels. As of 2021, there are 44 million young adults ages 25 to 34, meaning there would be 4.3 million additional homeowners.

Forward-looking policies can help meet young generations’ housing needs

Our research shows that those who buy their homes earlier in life, on average, have substantially higher housing wealth as they near retirement. Our previous research suggests that those ages 25 to 34 who live with their parents are significantly less likely to form independent households and become homeowners, compared with those who moved out earlier and either rented or owned. A significant decline in the real homeownership rate means more of today’s young adults won’t be able to build wealth through housing equity the way older generations did.

But the increase in this less independent younger generation who face unique barriers to homebuying underscores the need for targeted solutions, such as the following:

- Providing smaller and less expensive housing units and lending products would help these households access independent living arrangements, whether rental or ownership.

- Increasing the amount of housing single-earner young adults can afford and finding ways to increase supply through upzoning would reduce home prices and rents.

- Improving financing and easing the financial constraints of condominium financing and expanding manufactured housing financing would be a meaningful step.

- Streamlining government-insured mortgages that are commonly used by young first-time homebuyers, providing well-targeted interest rate buydowns, and expanding small-dollar mortgages could also increase the competitiveness and the purchasing power of single-earner young adults.

Our new analysis shines a light on the effects of young adults’ living arrangements and marital status on their true homeownership rate, but more research is needed to understand why young adults today are making different choices from past generations and what supports they need to access such a large wealth-building opportunity.

Let’s build a future where everyone, everywhere has the opportunity and power to thrive

Urban is more determined than ever to partner with changemakers to unlock opportunities that give people across the country a fair shot at reaching their fullest potential. Invest in Urban to power this type of work.