Changes in the housing market before and after previous storms reveal the challenges that face Texas, Florida, and Puerto Rico following this year’s devastating hurricane season. Two key factors will have a big impact on the path and pace of recovery: the type of damage that occurred, and the state of the local housing market before the storm hit.

Insights from our new hurricane fact sheets, which focus on Harvey, Irma, and past storms, help reveal the current situation in the affected areas’ housing markets, lessons from previous storms, and the challenges ahead.

Flood damage or wind damage?

While both were hurricanes, Harvey and Irma left different forms of destruction in their wakes. The southeastern coast of Texas saw massive flooding, caused by record amounts of rainfall. In Florida, immense storm surges were narrowly avoided by last-minute shifts in Irma’s path, so high winds caused much of the damage.

What does this mean for homeowners seeking to rebuild and hoping to get help from insurance? In Texas, many of the areas that flooded were outside traditional floodplains, so many homeowners do not have flood insurance. In Florida, on the other hand, not only were more owners covered by flood insurance, but wind damage is generally covered by traditional homeowner’s insurance.

State of the local housing market: Flailing or flourishing?

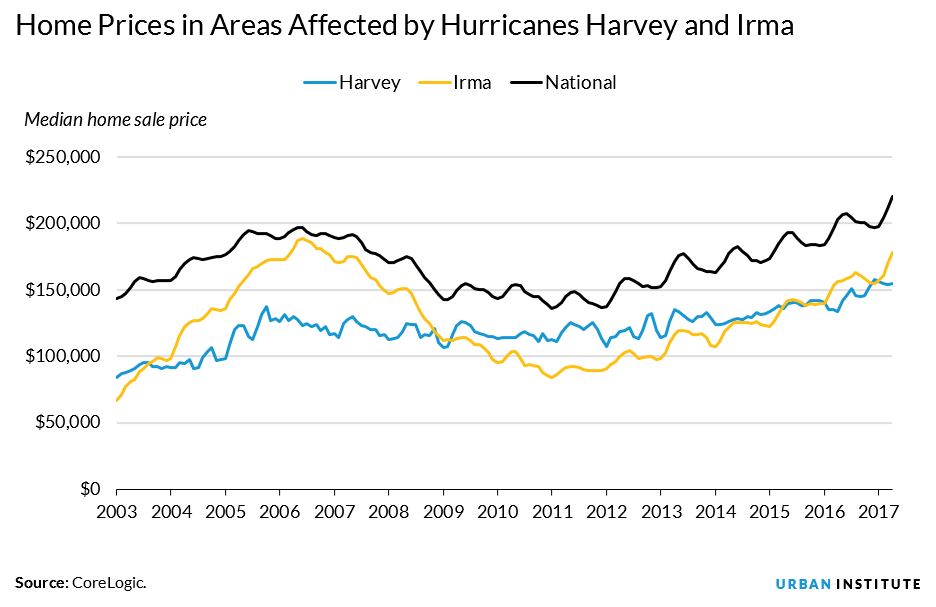

Florida’s housing market, which was hit harder by the housing boom and bust, has been more volatile than the Texas market over the past 10 years. In the region affected by Hurricane Irma, home prices fell more than 50 percent from their peak during the housing crisis and have only recently returned to their precrisis levels.

Texas, on the other hand, was less dramatically affected by the crisis. Home prices in the region affected by Hurricane Harvey have been more stable than the national average and more stable than the area affected by Irma, returning to their precrisis peak in 2013.

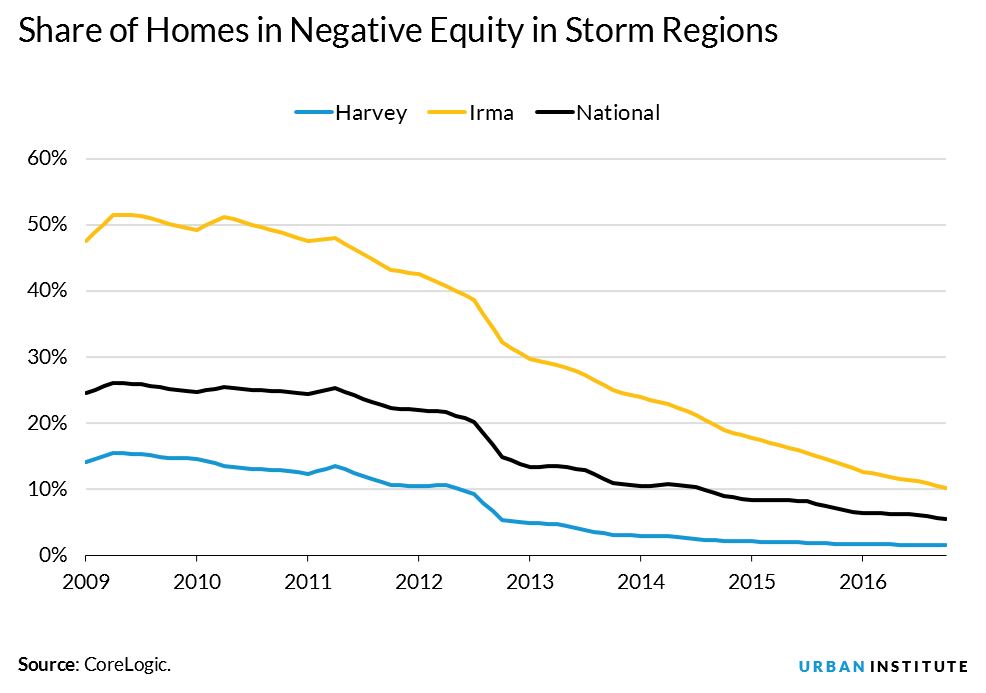

Florida is still feeling the effects of the crisis in other ways. The state has the second-highest rate in the nation of borrowers in negative equity, behind only Nevada. A little over 10 percent of borrowers in this region were still underwater on their mortgages before Irma hit, nearly twice the national average.

This has serious implications for how Florida will react to the massive amount of damage to the housing stock. Borrowers in or near negative equity who face significant damage to their homes may have little incentive to stay in their homes, and the rate of borrowers who default may spike.

Conversely, the region affected by Harvey has been consistently below the national average, with only 1.45 percent of borrowers in negative equity before Harvey hit. This means more owners will have a stronger incentive to rebuild or repair their damaged homes.

Lessons we can and can’t learn from past storms

When we look at Harvey and Irma, there’s a temptation to compare them with past storms. But the damage from any storm is unlikely to follow a prescribed path. The storms’ impacts differed based on the size of the damage relative to the local economy. Hurricane Katrina, for example, hit New Orleans directly, whereas Hurricane Sandy’s impact was more dispersed and was felt throughout the New York and New Jersey area.

But studying past storms is useful to understand the potential impact of housing market timing and disaster relief on patterns in mortgage market metrics such as delinquency and foreclosure.

After Hurricane Katrina, delinquencies skyrocketed, but foreclosures declined. Studies have found that after Katrina, there was a reduction in debt because homeowners used their flood insurance and government disaster recovery payments to repay their mortgages instead of rebuild their homes.

Many people in distress sold their properties to state governments (allowable under many buyout programs). Ultimately, mortgage servicers were less likely to foreclose on homes that were destroyed and located in neighborhoods that were likely to struggle financially and economically for the foreseeable future.

When we look at these numbers, we also need to remember that the housing boom-and-bust cycle plays a large role in storm impacts. The mortgage market was almost at its peak when Hurricane Katrina hit in 2005, and credit standards were lax.

In contrast, Hurricane Sandy hit seven years later, when lending standards were tight in response to the housing crisis. Hurricanes Harvey and Irma come as the market is on its way toward recovery, with national home prices just surpassing their previous peak.

Data allow us to understand local housing market conditions and the challenges faced by each community after a storm. We hope our new fact sheets, which we’ll update as new data are made available, will be a useful tool for understanding, planning, and implementing an effective recovery of the local housing markets.

We also hope monitoring how these key data points change over time will be useful to mortgage servicers, policymakers, insurers, and investors as they think about housing-related responses to future disasters and ensure we have the right tools to support communities, who will have different needs, through times of crisis.

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.