A version of this post originally appeared on Redfin.

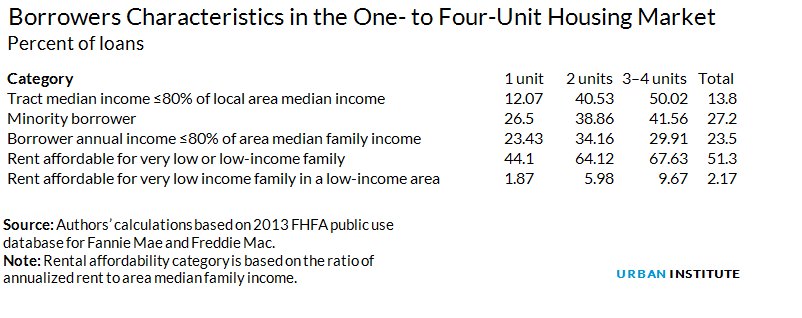

In 2013, nearly one-fifth of the nation’s rental apartments were in two- to four-unit buildings. These buildings play an essential role in the rental market because they are prevalent in underserved communities and more likely to be owned by minorities and affordable to very low income families than other rental units.

In a new study, we show that these buildings could further expand affordable rental housing if we make them easier to finance and help borrowers be better landlords.

Two- to four-unit buildings were hit hard by crisis

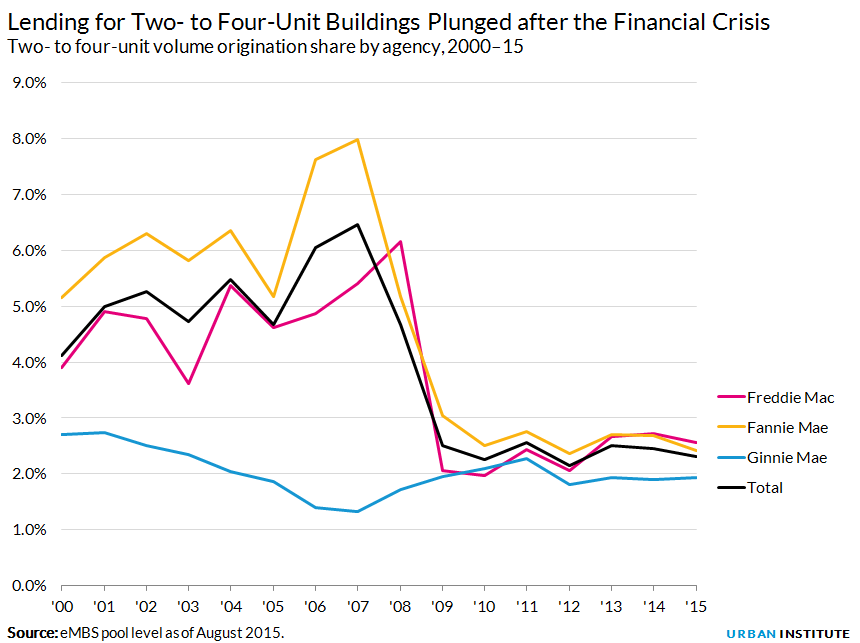

Two- to four-unit properties have always made up a tiny share of total single-family lending, but their importance is unequivocal. From 2000 to 2007, these units comprised between just 5 and 6 percent of all single-family lending but provided 19 percent of the rental housing stock and an even higher share of the affordable housing stock.

Unfortunately, financing these units has become difficult: lending plunged to just 2 to 3 percent of the market after 2009, reflecting tightened loan-to-value requirements since the housing crisis.

Standards are too high for two- to four-unit properties

The government-sponsored enterprises established rules that are causing lenders to shy away from borrowers who want to finance two- to four-unit properties, but is this justified? To answer this question, we used newly available data to analyze the default and liquidation performance of 14 million mortgages made throughout the country for one- to four-unit buildings.

Here’s what we found:

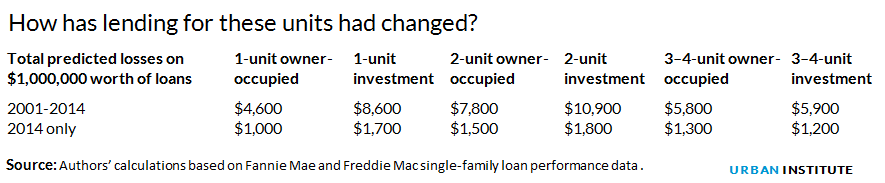

We established a clear order of likely losses that has been mostly consistent throughout the 15 years:

- One-unit owner-occupied (lowest losses)

- Three- to four-unit investment

- Three- to four-unit owner-occupied

- Two-unit owner-occupied

- One-unit investment

- Two-unit investment (highest losses)

Two details from the analysis suggest that standards are too high for two- to four-unit properties:

- Lenders are tolerating significantly less loss than before. The predicted loss numbers for the 2014 loans are much lower than the 15-year average. Lenders accepted greater losses within each category but have increased down payment and credit score requirements to significantly reduce losses. This lower tolerance for risk is consistent with our findings that mortgage lending today is predominantly accessible only to borrowers with nearly pristine credit.

- Two- to four-unit properties have about the same risk as one-unit owner-occupied properties. Historically, there was a big spread between predicted losses on two- to four-unit loans and on one-unit owner-occupied loans. Lenders tolerated losses between $5,800 and $10,900 per $1 million for two- to four-unit properties but only $4,600 in losses for one-unit owner-occupied properties. But as of 2014, the tolerated losses for two- to four-unit properties—$1,200 to $1,800—look remarkably similar to those of one-unit properties.

Given the importance of two- to four-unit properties in supporting affordable rental housing and fostering homeownership in underserved communities, policies need to encourage lenders to increase their loss tolerance for these types of properties. We recommend that policymakers implement two solutions:

- Counseling for borrowers: Ensure that borrowers for two to four-unit properties, particularly owner-occupants, have counseling on how to minimize and manage income variability, as well as how to be a landlord in a small building.

- Easing down payment requirements: The government-sponsored enterprises increased the down payment requirements for two- to four-unit loans out of concern over higher default rates. While losses on two- to four-unit properties are now on par with one-unit owner-occupied properties, the low volume of loans suggests many (likely minority) borrowers are getting squeezed out of the market. To expand credit to underserved populations and increase, or at least preserve, the supply of affordable rental housing, the government-sponsored enterprises could relax loan-to-value requirements. If this change were coupled with counseling for landlords, it could largely offset the costs.

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.