A key sticking point in the government shutdown debate is the upcoming reductions in the premium tax credit (PTC), particularly how the credit declines as income increases. Without action by Congress, the reductions expected in 2026 include reimposing an eligibility cliff at 400 percent of the federal poverty level—a bit over $60,000 for a single person. With the cliff in place, the tax credit falls suddenly to zero when income crosses this line.

As data centers see a surge in demand because of generative AI, Henrico County, Virginia, shows how local governments can turn the economic gains of this new industry into sustainable funding for affordable housing.

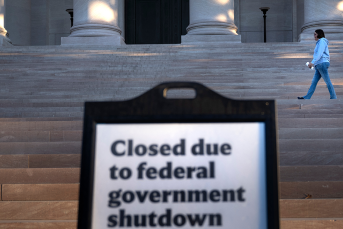

In this article, we explain nonprofits’ role in thriving communities, the amount of funding nonprofits receive from government sources, and the government funding challenges nonprofits were facing before the shutdown.

The One Big Beautiful Bill Act’s (OBBBA’s) changes to the child tax credit (CTC) and other programs, like tax benefits for child care, the adoption tax credit, and tax-advantaged savings accounts for children called “Trump accounts,” are projected to increase tax benefits for children in nominal terms by over $30 billion in fiscal year 2034.

DC policymakers considering TOPA changes should understand the implications for owners and renters of two-to-four-unit rental buildings.

Read: Making Their Voices Heard: Improving Research through Community Collaboration.

Read: Why Investing in Trusted Community-Based Organizations Is Crucial to Sustainability.