Adequate housing supply is critical to ensuring affordability. But for the past few decades, private investment in new housing construction has slowed, and government subsidies for affordable housing have failed to keep up. As a result, housing is more expensive than ever for many Americans.

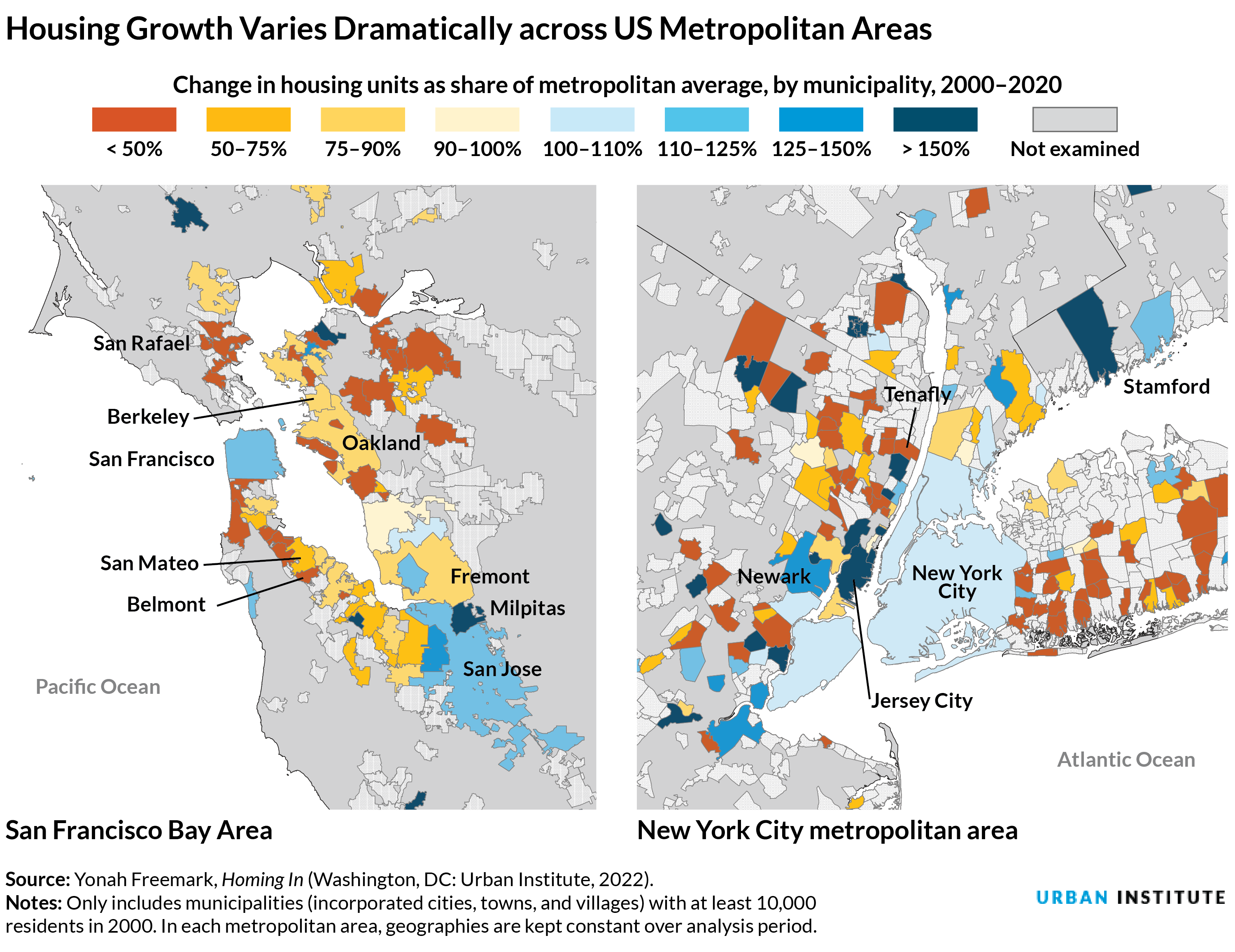

Though the national story is clear, changes in housing supply vary considerably within metropolitan areas, with some communities adding plenty of homes, and others losing them as they demolish buildings and convert small multifamily buildings into individual homes.

In new research, I examined these patterns in municipalities across the United States between 2000 and 2020. I found variation within metropolitan areas stems from two primary trends: significant housing underproduction not only in undervalued communities that cannot attract development but also in many high-housing-cost communities that have leveraged land-use regulations to prevent new construction despite local demand for construction. There is no one-size-fits-all solution to the problem; boosting supply will require federal, state, and local policymakers to collaborate and tailor production approaches to each type of community.

Both the lowest- and the highest-value communities underproduced housing

For my analysis, I examined median housing values, permitting data, and local demographics. I compare the amount of housing added in municipalities nationwide against overall metropolitan growth and specifically examine the most exclusive cities—those with high housing values in growing metropolitan areas, that feature little housing growth.

I found the US cities with the lowest-value housing stock (places where homes are worth less than half the regional average) experienced extremely slow housing-unit growth between 2000 and 2020. The median such jurisdiction added housing units at only 10 percent of the rate of its encompassing region.

This speaks to the difficulty such undervalued communities—places like Gary, Indiana; Reading, Pennsylvania; or Trenton, New Jersey—face in attracting development. Whether or not local decisionmakers want more housing, it simply isn’t being built within their boundaries.

On the other hand, many municipalities with housing values at or above those of their respective metropolitan areas built considerably more housing on average. Such communities include wealthy suburbs like Alpharetta, Georgia, and Glenview, Illinois, and central cities like Seattle. This suggests developers are building in areas where they believe they’ll get a reasonable return on their investment.

I found higher municipal housing-unit growth and permitting were also associated with higher median household incomes and educational attainment on average. Again, this indicates development is likely to follow the people who can pay for housing units in new-construction buildings.

But this story is nuanced. Many of the most attractive communities—with some of the priciest housing stock—block development. They are likely using land-use regulations that prevent apartments from being built to limit construction, reducing housing availability and increasing housing costs.

Indeed, of the nation’s most-in-demand municipalities—those where housing values are at least 30 percent higher than their respective metropolitan areas—less than a third added more housing than their encompassing region, despite plentiful developer demand to build there. In contrast, more than 40 percent of such jurisdictions added new housing at 50 percent or less of the rates of their respective metropolitan areas—and many actually lost housing units.

Municipalities with relative housing values between 110 and 130 percent of metropolitan averages added the most housing overall.

Development patterns vary by metropolitan area

Most US regions disproportionately added new housing in exurban, sprawling, unincorporated areas between 2000 and 2020. These areas typically have the fewest regulatory constraints on new construction and lower construction costs. But trends vary widely between metropolitan areas.

In the San Francisco Bay Area—the most expensive large urban region in the nation—San Francisco and San Jose added housing units at roughly the metropolitan average, or above it, over the past two decades (though the region is not adding enough housing to keep up with demand). But many of the smaller, wealthier suburbs surrounding them, like Belmont, added housing at only half of the regional rate. Those communities became increasingly expensive at the same time.

In the New York City region, several large suburban cities like Hoboken, Jersey City; Newark, New Jersey; and Stamford, Connecticut, added proportionately more new units between 2000 and 2020 than New York City. Meanwhile, exclusive communities like Tenafly, New Jersey—with median household incomes of more than $170,000—built very few new units.

The most exclusionary communities raise unique challenges

In some ways, cities like Belmont and Tenafly reflect nationwide trends. These in-demand municipalities don’t suffer from the deficit in development demand their low-value peers face. Yet evidence shows many local governments use restrictive land-use regulations, like zoning policies limiting development to large-lot single-family homes, to prevent construction. Though communities like Jersey City have allowed the construction of large towers, Tenafly has enforced a zoning code (PDF) that prevents anything but single-family homes from being built on most of its territory.

Similar stories can be told about the zoning rules in many in-demand, low-housing-production cities, such as Calabasas, California; Hudson, Ohio; Scarsdale, New York; and University Park, Texas.

Ultimately, this means many wealthy suburbs free ride on the attractiveness of their metropolitan areas, watching their property values grow in response to demand—while gas station attendants, teachers, and service industry workers are priced out because of limited housing availability.

How policymakers can address housing shortages nationwide

The Biden administration recently introduced a national Housing Supply Action Plan that proposes a set of new policies the federal government could undertake to address the nation’s underproduction of residences. This is a good start for what unquestionably will require action by local and state governments as well.

To address the housing development shortage within undervalued communities, governments at all levels should consider increasing place-based investment in residential construction, such as through direct investment in units through social housing programs. This could also attract private developer interest in undervalued neighborhoods, ultimately leading to more units and amenities that could give residents a better quality of life.

To address inadequate housing construction in high-value, in-demand communities, the federal government and states should consider leveraging financial and political tools to encourage or require these jurisdictions to do their part to house a fair share of the region’s residents of all backgrounds. Such leverage could include conditioning transportation, infrastructure, and housing grant support on land-use rules encouraging housing development. In France, a mandate that cities demonstrate real progress in providing affordable housing has been successful. States could also take lessons from California and Oregon and consider overriding local rules that limit housing construction to just single-family units.

The US’s housing shortage crisis is widespread but uneven. Policymakers must evaluate and understand housing stock variation within metropolitan areas so they can tailor production approaches accordingly for maximum impact.

Let’s build a future where everyone, everywhere has the opportunity and power to thrive

Urban is more determined than ever to partner with changemakers to unlock opportunities that give people across the country a fair shot at reaching their fullest potential. Invest in Urban to power this type of work.