In recent years, there has been increased attention on racial and ethnic disparities in mortgage lending. News outlets have covered racial lending disparities in neighborhoods where Black and Latino residents make up the majority, the US Justice Department announced an initiative to combat modern redlining, and advocacy organizations criticized the proposed Community Reinvestment Act (CRA) revisions for not explicitly considering race.

Evidence shows place-based programs are a good way to address systemic racism because economic opportunity is not distributed equally across geography. Tactics like redlining, the process by which the government adopted color-coded maps that effectively barred households of color from mortgage access, and single-family zoning, which emerged in the 1920s after the Supreme Court outlawed race-based zoning, produced racially segregated neighborhoods with vastly different financial assets. These practices contributed to and bolstered the racial wealth gap and are just several examples of the geographic structure and reinforcement of opportunity.

But neighborhood segregation is not always the complete explanation for racial disparities in lending outcomes.

In a new analysis, we find neighborhood racial makeup is an inconsistent predictor of racially disparate lending outcomes nationwide. Despite declines in residential segregation, Black and Latino households struggle to become homeowners both within and outside neighborhoods of color. Policymakers and housing stakeholders seeking to close racial homeownership gaps should thus consider where and when to use place as a proxy for race to ensure Black and Latino borrowers in predominantly white areas are not left behind.

Racial disparities in mortgage denial rates are present nationwide

To conduct our analysis, we first examined denial rates by race and neighborhood racial makeup. We looked at applications for first-lien home equity loans in 2021. We defined majority-white areas as census tracts where white residents made up at least 50 percent of residents, and we defined neighborhoods of color as census tracts where white residents made up less than 50 percent of residents. Because we were particularly interested in how the proportion of white residents in a census tract affected denial rates for borrowers of color, we did not further disaggregate neighborhoods of color, which we recognize can mask important differences and should be a topic for future research.

For all applicants, the denial rate was 14.2 percent in neighborhoods of color and 9.4 percent in majority-white neighborhoods. Nationwide, racial disparities at the neighborhood level do occur and deserve attention.

Notably, among Black and Latino applicants, denial rates by neighborhood racial makeup differed by less than 2.2 percentage points. Black and Latino applicants remained more likely than white applicants to have their mortgage applications denied, regardless of neighborhood racial makeup.

Racial disparities in denials hold up at the national level with controls

When controlling for debt-to-income ratio, loan-to-value ratio, income, and tract-to-metropolitan statistical area (MSA) income level (or the percentage of tract median family income compared with MSA family income), Black and Latino applicants remained more likely to be denied than white applicants in the same tracts, regardless of neighborhood racial makeup. We did not have access to credit data, but researchers from the Federal Reserve Bank of Minneapolis similarly found Black and Latino applicants remain significantly more likely to be denied than white applicants when controlling for credit score.

Black applicants were between 1.8 and 2.5 times as likely to be denied as white applicants with similar observable borrower characteristics in all neighborhood types. The same trends held for Latino borrowers, who were roughly 1.5 times as likely to be denied as white applicants across neighborhood types.

Systemic racism is woven into the fabric of our housing finance system, but it manifests differently in different states and cities

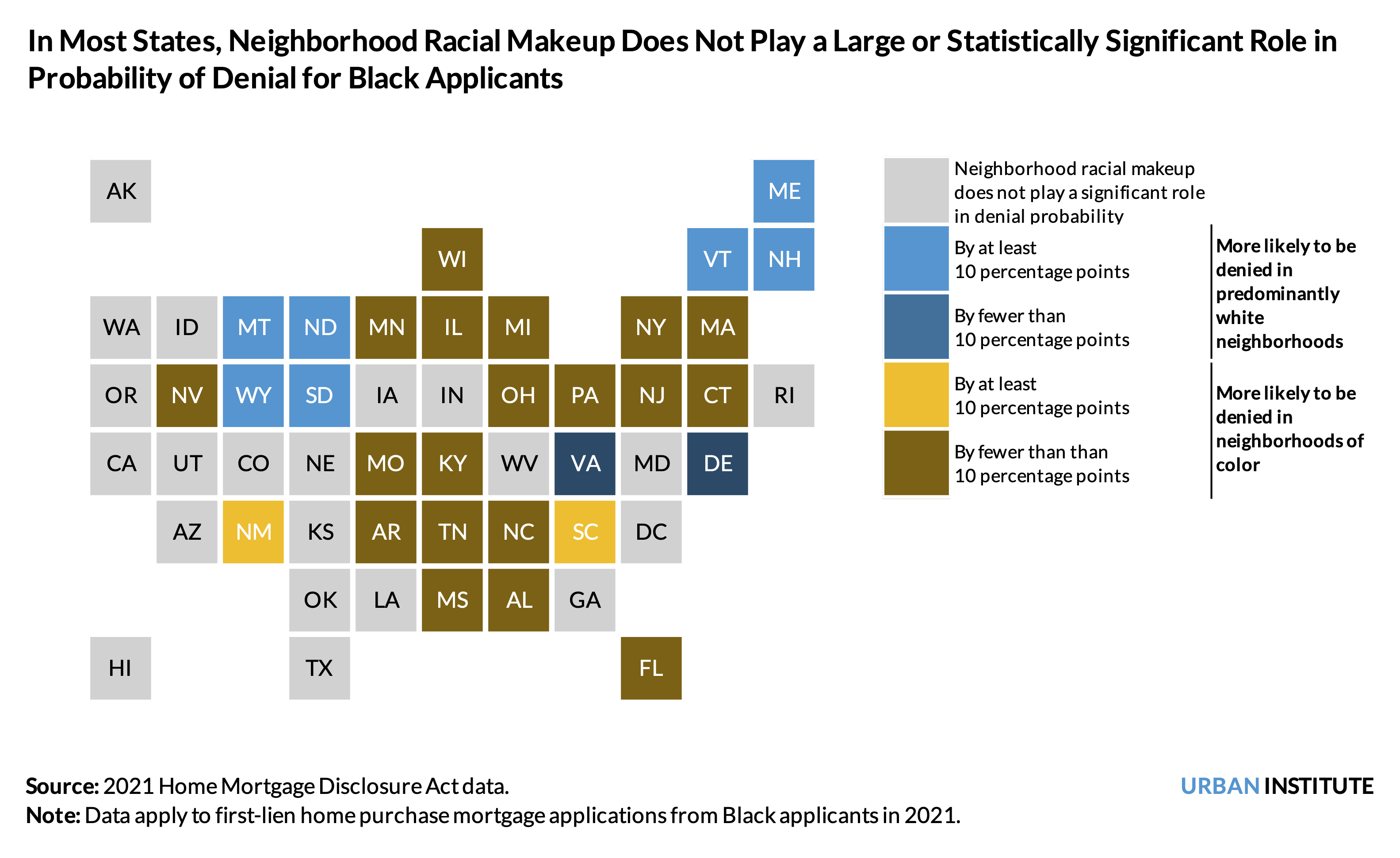

In some states, neighborhood racial makeup significantly and sizably affects denial probability (at least 10 percentage points). Black applicants experience greater denial rates in neighborhoods of color by more than 10 percentage points than in majority-white neighborhoods in only New Mexico and South Carolina.

Interestingly, in seven states, Black applicants experience higher denial rates in majority-white neighborhoods than in neighborhoods of color. In several of these states, borrowers didn’t apply for mortgages in neighborhoods of color or there were no such neighborhoods in the state, and Black applicants were therefore denied only in majority-white neighborhoods.

In the remaining 41 states and the District of Columbia, the role of neighborhood racial makeup on denial probability is statistically insignificant, or the difference between neighborhood types was less than 10 percentage points.

The state-level trends do not hold across all MSAs within each state. We examined denial rates by neighborhood racial makeup at the MSA level for Black applicants and found variation across cities.

Metropolitan Statistical Areas with the Largest Denial Rate Differences for Black Applicants, by Neighborhood Racial Makeup

| Black applicants' denial rates are higher in neighborhoods of color | Black applicants' denial rates are higher in majority-white neighborhoods |

| Cape Girardeau-Jackson, MO-IL | Bloomsburg-Berwick, PA |

| Madera-Chowchilla, CA | Parkersburg-Marietta-Vienna, WV-OH |

| Jonesboro, AR | Carbondale, IL |

| Lima, OH | Homosassa Springs, FL |

| Fayetteville-Springdale-Rogers, AR-MO | Ames, IA |

Source: 2021 Home Mortgage Disclosure Act data (on first-lien home purchase applications from Black applicants) and 2016–20 American Community Survey data.

Notes:The listed MSAs are the five where the denial rate differences are largest nationwide. They are listed by the largest difference.

We completed the same analyses for Latino applicants and found similar results. Trends held, with some state- and city-level differences.

Lenders cannot deny applicants because of their race, but they can deny applicants because of factors like credit score, which are supposedly race-neutral. But research underscores that decades of historical discrimination in communities of color led to denial of banking and credit-building services, and people of color today are therefore less likely to meet lenders’ credit requirements. Interestingly,we found that for Black applicants, the share of denials attributable to credit history increased with the proportion of white residents in a census tract.

How can policymakers and housing stakeholders ensure borrowers of color don’t get left behind?

To ensure Black and Latino borrowers in majority-white areas aren’t overlooked, decisionmakers seeking to close the racial homeownership gaps should consult data to assess where and when to use place as a stand-in for race. Our findings underscore that because there’s significant state-to-state and within-state variation, place-based programs alone won’t root out discrimination; instead, a combination of place- and people-based programs would likely be most effective.

Locally, programs that seek to close the racial homeownership gap, such as special purpose credit programs, can use these findings to inform which cities to target and how best to reach affected borrowers.

On the national level, the CRA uses neighborhood and borrower characteristics, but it uses income level as a proxy for race, despite research showing it’s an inconsistent proxy. CRA revisions, and emerging state-level CRA requirements, could consider race explicitly to better target the state-specific manifestations of lending discrimination.

Place-based programs are a valuable tool to address historical discrimination, especially because they enable programs to effectively reach households of color. Nonetheless, place is an incomplete proxy for experience of systemic racism in mortgage lending. Our data can help policymakers ensure programs created to erode racial and ethnic disparities fulfill their goals.

Let’s build a future where everyone, everywhere has the opportunity and power to thrive

Urban is more determined than ever to partner with changemakers to unlock opportunities that give people across the country a fair shot at reaching their fullest potential. Invest in Urban to power this type of work.