Though rent increases across the United States have largely moderated, rental affordability is as bad as it has ever been: 50 percent of renters in the country are cost burdened, paying more than 30 percent of their income for rent.

Apartment List’s 2024 National Rent Report tracks year-over-year rent growth at -0.8 percent, yet national median rents are $200 higher than several years ago. And the Harvard Joint Center for Housing Studies has further documented the increasing loss of low-cost rental units.

New solutions are needed to support renters—especially those with low incomes, who face the greatest financial strain. But where will they come from?

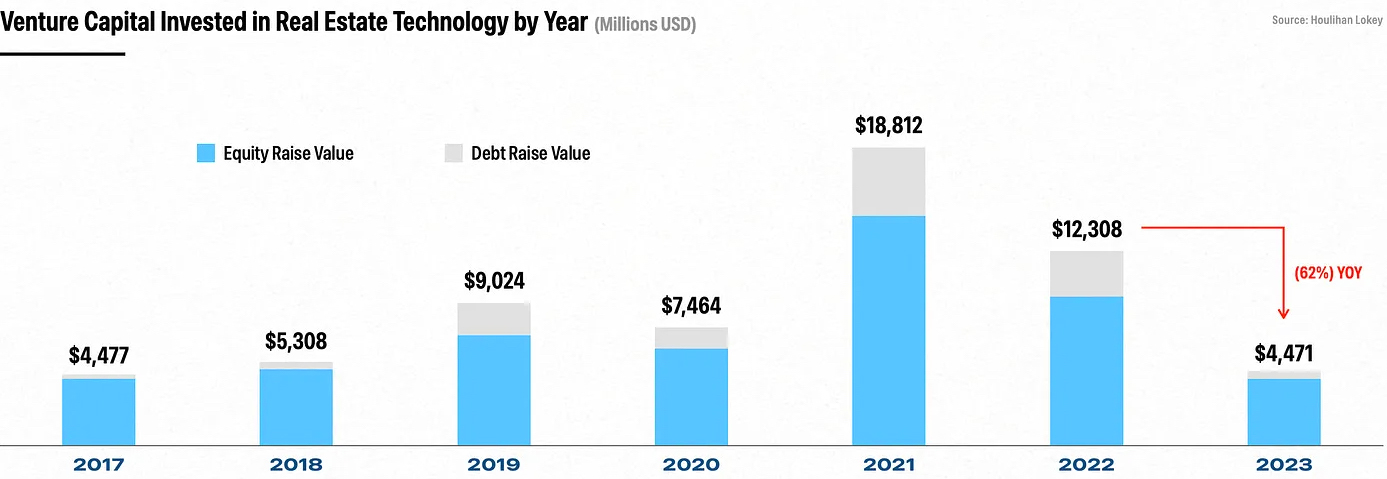

For the past decade, significant funding for financial innovation has come from the private market (PDF). When interest rates were historically low, private capital flowed to venture capital and private equity funds. In turn, venture capital and private equity funds poured money into many sectors, including hundreds of start-ups focused on real estate and housing, such as Rhino, EasyKnock, Digs, and Esusu.

But as the Federal Reserve has raised interest rates, venture-backed housing solutions have paused operations, shut down, or pivoted their models to stay afloat. At the same time, inflows to venture capital and private equity funds have slowed, limiting access to funding for new models and initiatives to address housing affordability.

Source: Houlihan Lokey

This imbalance between need and available innovation funding has provided an opportunity for new organizations less dependent on private capital to enter the space. Today, public-sector and nonprofit models are taking center stage.

Three approaches of public-sector and nonprofit innovation stand out as potential game-changers. These organizations have been recognized in the finance category of the 2024 Ivory Prize for Housing Affordability, a competition that highlights the most innovative solutions for housing affordability.

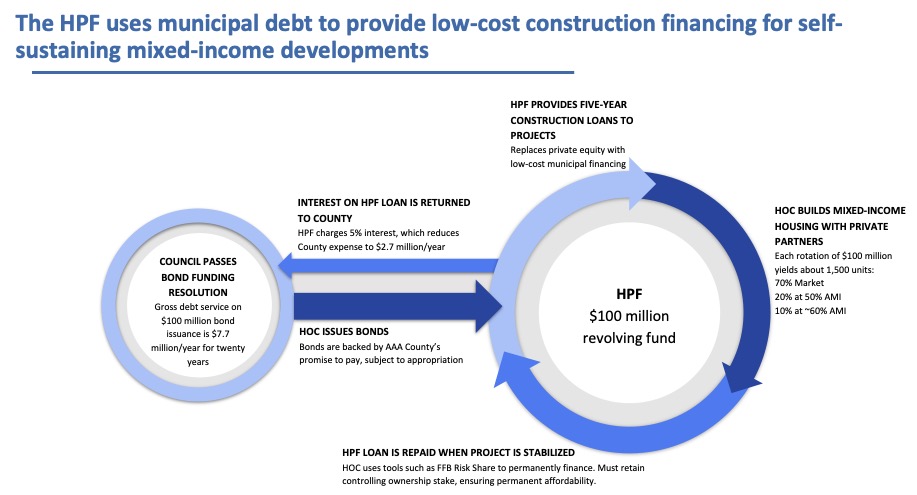

Montgomery County Housing Opportunities Commission: Enabling housing production with a low-cost revolving construction loan fund (2024 Ivory Prize winner in finance)

In 2021 and 2022, the Housing Opportunities Commission of Montgomery County authorized $100 million in bonds to create a low-cost revolving construction loan fund called the Housing Production Fund (HPF). The HPF focuses on building mixed-income rental units, providing a lifeline for people struggling to find affordable housing and fostering economic diversity within communities. With its $100 million bonding capacity, the HPF can finance up to 6,000 new housing units over 20 years, of which 1,800 will be affordable in perpetuity to renters earning between 50 and 65 percent of the area median income.

After construction is completed and units are leased, the initial bond financing is rolled over to permanent financing, paying back the principal balance to the HPF and unlocking those dollars to finance additional construction loans.

As both public entities and private developers across the country look to fill financing gaps for new rental housing, Montgomery County’s model demonstrates a new source of public funding that enables mixed-income buildings and provides affordability protections in perpetuity.

Source: Housing Production Fund

HIAS: Creating a housing guarantee fund to support refugees seeking rental housing (2024 Ivory Prize top-10 finalist)

Refugees often lack savings, credit scores, and other key requirements for private landlords. As a result, they face distinct housing challenges as they acclimate to life in the United States. To meet the critical housing needs of newly arrived refugees, the Hebrew Immigration Aid Society (HIAS)—the nation’s oldest refugee resettlement agency—developed the HIAS Housing Guarantee Fund (HGF) in 2022 to increase access to housing opportunities for refugee clients.

This fund has proven that cosigning or guaranteeing leases on behalf of refugee clients significantly broadens their housing options and increases housing security. As of January 2024, the HGF pilot has helped more than 500 refugee families access new housing opportunities in 14 cities across the country, with the capacity to serve 1,616 families in the first two years. Through additional fundraising and investment, HIAS seeks to expand the HGF to serve 10,000 refugees within the next five years.

This model brings an innovative approach to a renter population overlooked by many.

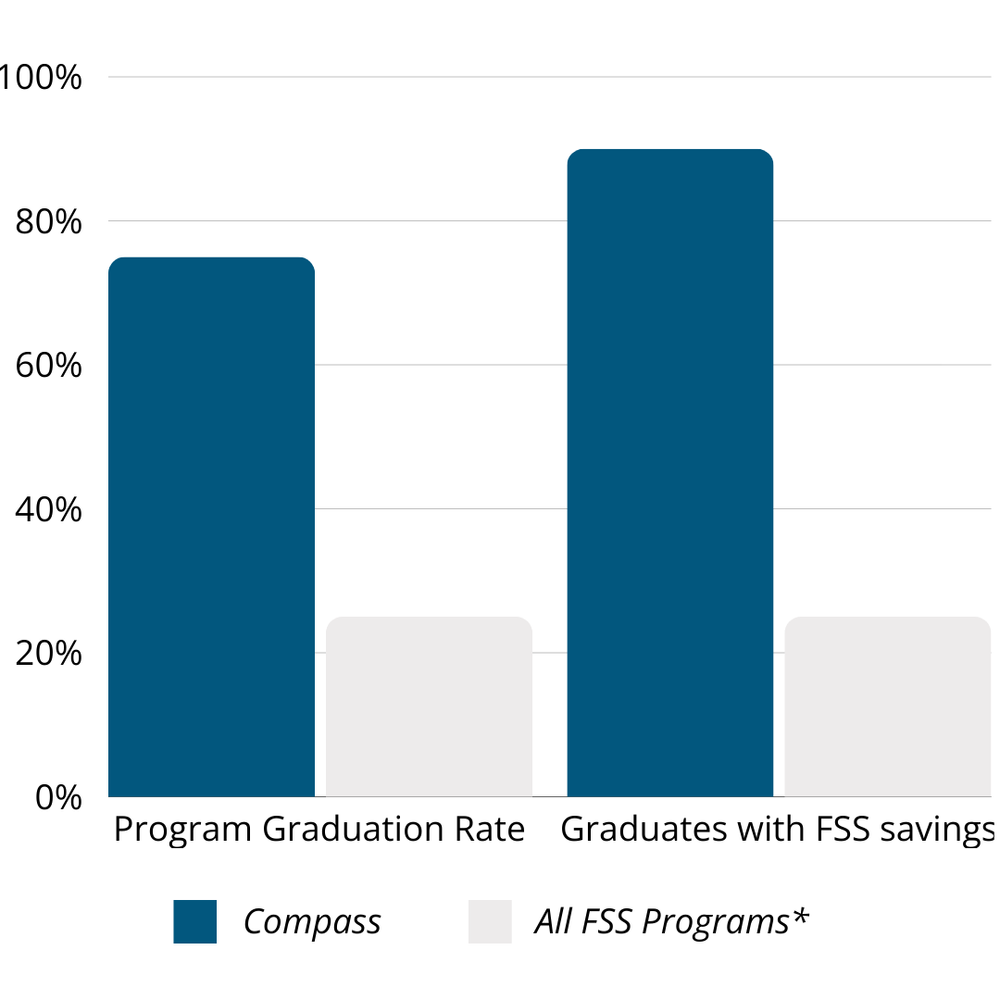

Compass Working Capital: Expanding the reach of the Family Self-Sufficiency Program (2024 Ivory Prize top-10 finalist)

Compass Working Capital (CWC) is committed to ending asset poverty for families with low incomes and narrowing racial and gender wealth gaps. CWC has launched a program to support the expansion and use of the US Department of Housing and Urban Development’s Family Self-Sufficiency (FSS) Program. Across the country, CWC estimates that up to 65,000 families are enrolled in the underused FSS program, but 2.2 million families are eligible to participate.

The FSS program aims to transform housing assistance to provide a springboard to greater financial security. Those receiving rental assistance normally spend 30 percent of their income on rent; as their income rises, their rent rises. This program diverts the rent increase into an escrow savings account. To be eligible to receive these funds at the end of a five-year period, participants must have employment suitable to their skills, and the entire household must be free of cash assistance (Supplemental Nutrition Assistance Program and Medicaid benefits are exempt).

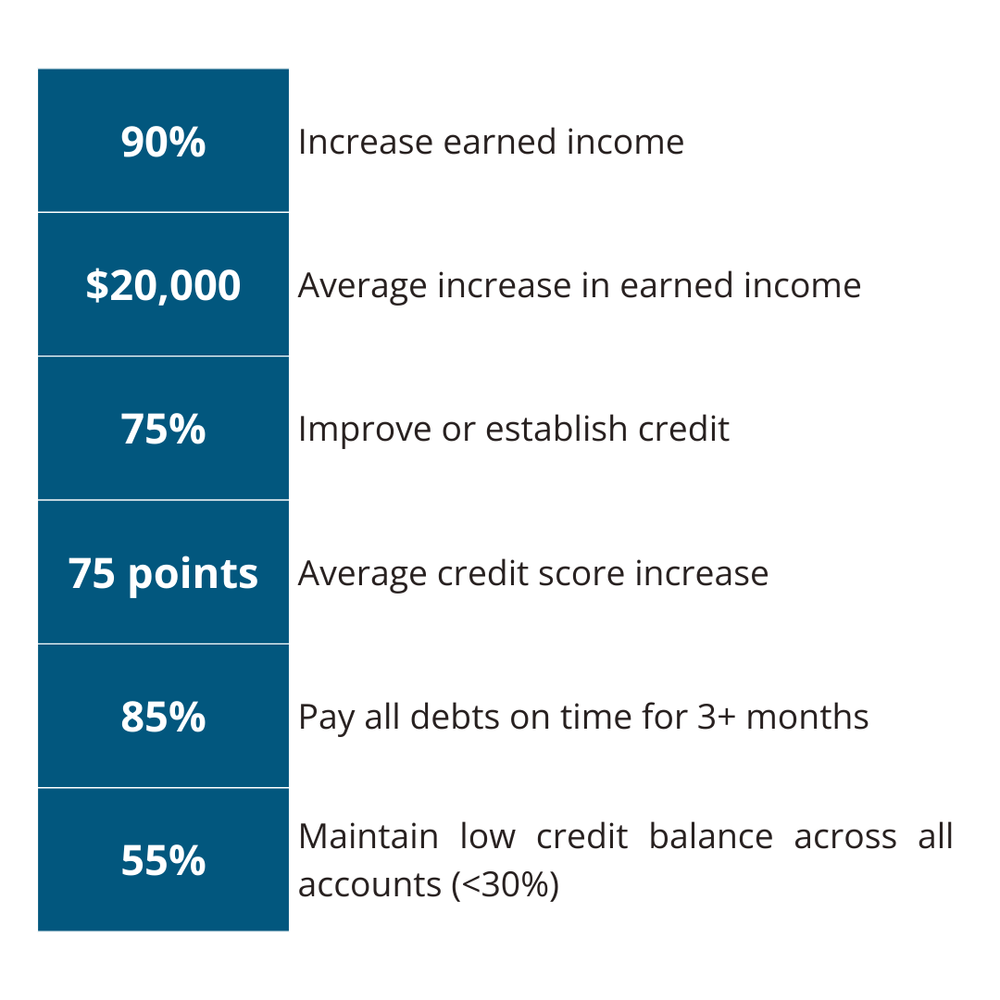

CWC is a driving force behind the implementation of this program. In 2023, it administered the program for 12 program partners, including three public housing authorities and four community development corporations. CWC also provides technical assistance to other nonprofits and public housing authorities where they are not the administrator. And CWC collects and tracks results, highlighting the program’s effectiveness. As of 2023, their program graduates save $9,000, on average, in their FSS escrow accounts. Seventy-five percent of graduates also have $400 or more in additional personal savings, while in 2022, only 63 percent of all US households could say the same. Furthermore, CWC reports that 15 to 20 percent of its FSS participants use their FSS funds to purchase a home upon graduation from the program.

Many venture-backed businesses have focused on renter savings programs or renter benefits. Yet as private capital and venture dollars slow, CWC’s expansion of an existing government program illustrates the ability of public-sector and nonprofit actors to lead the way in helping renters with low incomes achieve financial self-sufficiency, while collecting evidence to improve current programs.

Source: Compass Working Capital

These models are the result of valuable public and nonprofit contributions against a backdrop of limited private capital. Ultimately, support for renters with low incomes requires both private- and public-sector innovation and collaboration to unlock additional resources and expand impactful solutions.

As policymakers, advocates, industry, and the general public unite in the pursuit of affordable housing, innovative financing mechanisms and strategic partnerships will be essential in realizing a future where housing is accessible and affordable for all.

Let’s build a future where everyone, everywhere has the opportunity and power to thrive

Urban is more determined than ever to partner with changemakers to unlock opportunities that give people across the country a fair shot at reaching their fullest potential. Invest in Urban to power this type of work.