Earlier this week, we addressed the misconception that the Federal Housing Finance Agency (FHFA) is imposing pricing changes for Fannie Mae and Freddie Mac that will overcharge borrowers with good credit to undercharge those with bad credit. Three figures provide further clarity.

Here are FHFA’s new loan-level pricing adjustments for purchase loans.

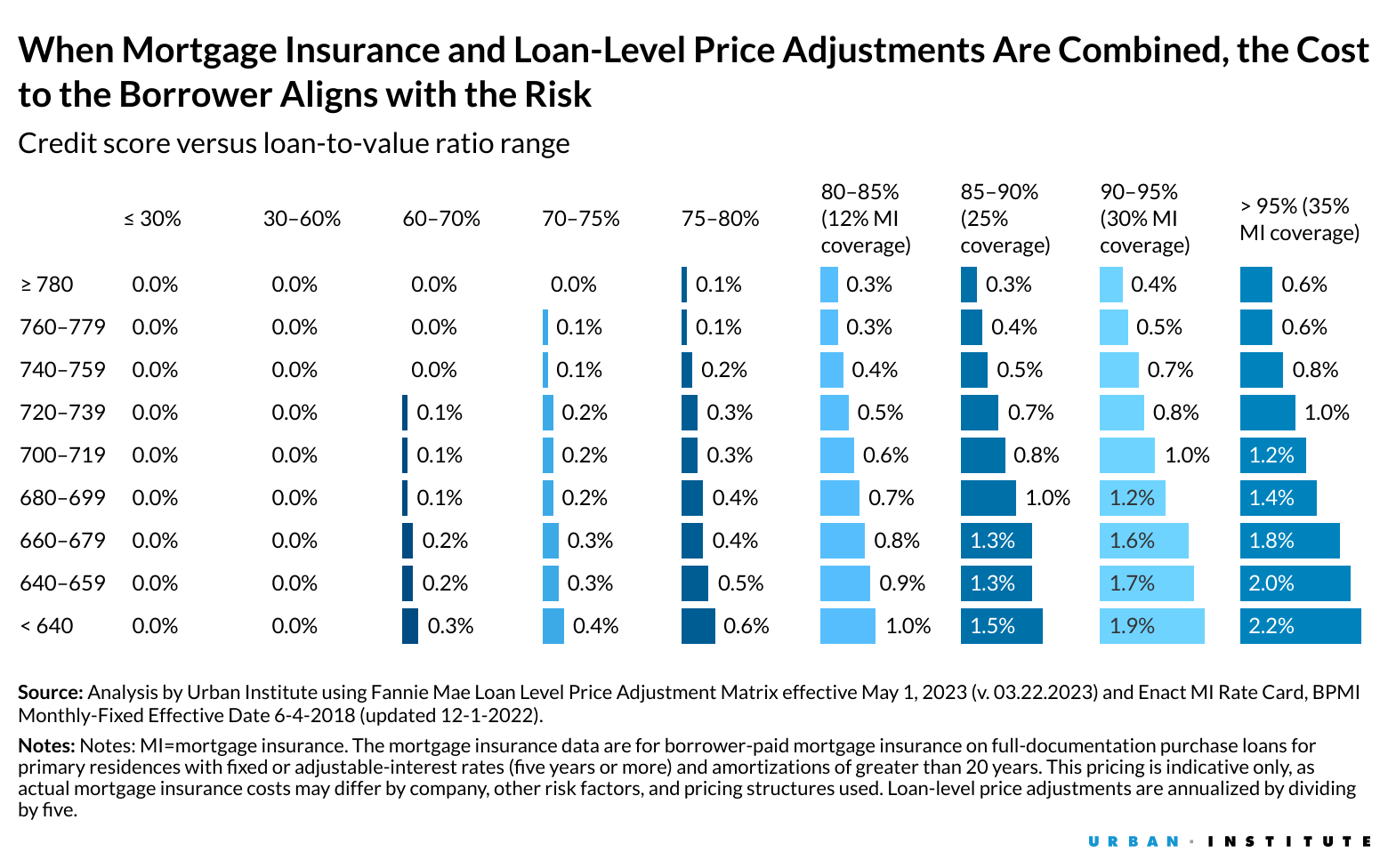

Some have suggested that the decline in fees for borrowers who put down a smaller down payment shows that FHFA is overcharging those who pose less risk to the government-sponsored enterprises (GSEs) so that it can undercharge those who pose more risk. But as we pointed out, this ignores the role of mortgage insurance, which every borrower who puts down less than 20 percent must purchase. This mortgage insurance moves some of the risk from Fannie Mae and Freddie Mac to a private mortgage insurer, which allows the GSEs to charge a lower loan-level price adjustment (LLPA). But the borrower, of course, pays a fee for the mortgage insurance. And when you add the cost of that fee to the total cost a borrower pays for their mortgage, the apparent disconnection between risk and price in the table above disappears, with borrowers’ payments rising or falling according to the risk they pose.

Instead of focusing on what pricing will look like in the new structure, some critics have pointed to a table that shows how pricing will change as we move from the old structure to the new one.

Those who cite this table claim that the reduction in fees for some higher-risk borrowers (in the green boxes) and increase in fees for some lower-risk borrowers (in the red boxes) show that lower-risk borrowers are now subsidizing higher-risk borrowers. But it doesn’t. It simply shows where FHFA has had to adjust pricing to align it with the new capital requirements or the underlying risk. Alone, it tells us nothing about cross-subsidy.

To see whether some borrowers are subsidizing others at a given moment, we must look at the pricing in place at that moment. So to assess whether the GSEs’ pricing will create a cross-subsidy when it goes into effect on May 1, we need to look at the numbers in the second table above. And those numbers clearly show it will not.

Let’s build a future where everyone, everywhere has the opportunity and power to thrive

Urban is more determined than ever to partner with changemakers to unlock opportunities that give people across the country a fair shot at reaching their fullest potential. Invest in Urban to power this type of work.