A key sticking point in the government shutdown debate is the upcoming reductions in the premium tax credit (PTC), particularly how the credit declines as income increases. Without action by Congress, the reductions expected in 2026 include reimposing an eligibility cliff at 400 percent of the federal poverty level—a bit over $60,000 for a single person. With the cliff in place, the tax credit falls suddenly to zero when income crosses this line.

DC policymakers considering TOPA changes should understand the implications for owners and renters of two-to-four-unit rental buildings.

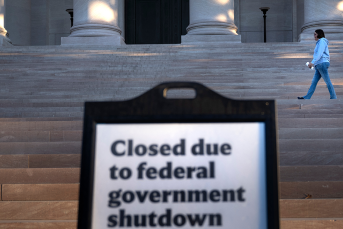

In this article, we explain nonprofits’ role in thriving communities, the amount of funding nonprofits receive from government sources, and the government funding challenges nonprofits were facing before the shutdown.

Without the office’s oversight, states could fall out of compliance with federal disability rights law and deny disabled students the services they are entitled to.

Setting housing targets can help policymakers create effective strategies that meet their specific supply and affordability needs.

Read: Making Their Voices Heard: Improving Research through Community Collaboration.

Read: Why Investing in Trusted Community-Based Organizations Is Crucial to Sustainability.