Will allowing the GSEs to guarantee smaller down payment loans in an effort to increase mortgage availability lead to more defaults? Some skeptics have raised this concern in response to the Federal Housing Finance Agency’s recent move to encourage lenders to issue mortgages with down payments as low as 3 percent. Based on a review of the performance of low-down-payme

nt GSE mortgages in recent years, however, these fears are not well founded. Fannie Mae and Freddie Mac (the GSEs), the guarantors of most of the nation’s mortgage debt, currently only purchase loans that have at least a 5 percent down payment. Prior to late 2013, however, Fannie Mae guaranteed loans with down payments between 3 and 5 percent. By examining the performance of these pre-2013 loans, we can get a sense of how likely it is that borrowers with similar loans will default going forward.

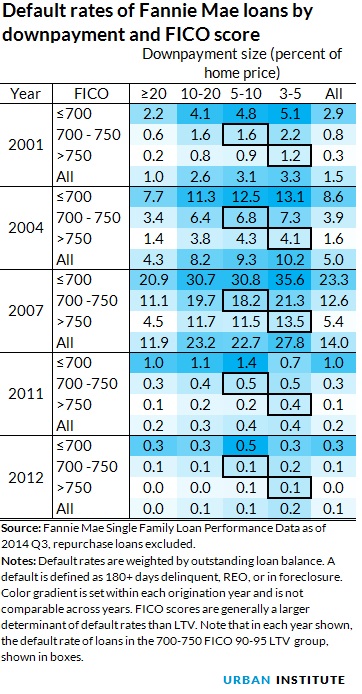

The default rates of 3-5 and 5-10 percent-down payment GSE loans are similar.

Loans that originated in recent years with down payments between 3-5 percent exhibit default rates similar to the default rates of those with slightly larger down payments—in the 90-95 LTV category.

Of loans that originated in 2011 with a down payment between 3-5 percent, only 0.4 percent of borrowers have defaulted. For loans with slightly larger down payments—between 5-10 percent—the default rate was exactly the same. The story is similar for loans made in 2012, with 0.2 percent in the 3-5 percent down-payment group defaulting, versus 0.1 percent of loans in the 5-10 percent down-payment group.

While this database is limited to 30-year, fixed-rate, amortizing mortgages (interest-only mortgages, 40-year mortgages, and negative-amortization loans are excluded), it is representative of GSE loans made in the post-crises period.

Borrower’s credit is a stronger indicator of default risk than down payment size with these loans.

The pattern is consistent even in the years leading up to the crisis, when overall default rates were much higher. In 2007, the worst issue year, 95-97 LTV loans in any given FICO bucket performed only marginally worse than the 90-95 LTV loans, and FICO score was a larger determinant of performance. For example, 95-97 LTV loans with a 700-750 FICO score have a default rate of 21.3 percent, versus 18.2 percent for 90-95 LTV loans. However, the 95-97 LTV loans with a FICO score above 750 had a 13.5 percent default rate, much lower than the 90-95 LTV loans with a 700-750 FICO score.

The GSEs' risk-based pricing means only a small group of lower-risk borrowers will end up with these loans.

This analysis tells us that there is likely to be minimal impact on default rates as low-down payment GSE lending gravitates towards borrowers with otherwise strong credit profiles. And this makes sense because GSE loans are priced on the basis of risk (including loan-level pricing adjustment and mortgage insurance costs), while Federal Housing Authority (FHA) loans are not. Thus, borrowers with high LTVs and low FICO scores will find it more economically favorable to obtain an FHA loan.

Furthermore, in recent years, a miniscule number of these loans were put back by Fannie Mae following a default, an action taken when Fannie determines that a delinquent loan was irresponsibly underwritten. The number of putbacks on 95-97 LTV loans over the entire 1999-2013 period was 0.5 percent, little different than the 0.4 percent for the 90-95 LTV bucket.

Those who have criticized low-down payment lending as excessively risky should know that if the past is a guide, only a narrow group of borrowers will receive these loans, and the overall impact on default rates is likely to be negligible. This low down payment lending was never more than 3.5 percent of the Fannie Mae book of business, and in recent years, had been even less. If executed carefully, this constitutes a small step forward in opening the credit box—one that safely, but only incrementally, expands the pool of who can qualify for a mortgage.

Let’s build a future where everyone, everywhere has the opportunity and power to thrive

Urban is more determined than ever to partner with changemakers to unlock opportunities that give people across the country a fair shot at reaching their fullest potential. Invest in Urban to power this type of work.