For a potential homebuyer with not much money, which is the better deal: a Federal Housing Administration (FHA) loan or a conventional loan that will be sold to government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac? In this month’s Housing Finance at a Glance, we explore that question and the market share of the private mortgage insurance (PMI) industry.

Private mortgage insurance is making a comeback

Since hitting a low in 2009, private mortgage insurers (PMIs) have slowly but surely been picking up market share compared with FHA and Veterans Affairs (VA) loans (figure below). Prior to the financial crises, private mortgage insurers were the primary insurance source for high loan to value (LTV) lending, representing almost 60 percent of the total in 2000 and 77 percent in 2007. By charter, Fannie Mae and Freddie Mac (the GSEs) cannot be in the first-loss position on mortgages greater than 80 LTV; these mortgages require mortgage insurance. After the financial crises, the mortgage insurers raised their premiums, while the FHA insurance premiums did not increase. As a result in 2009 and 2010, the FHA share ballooned, and the PMI share hit a low of 15 percent. Since then, FHA insurance premiums have been raised several times, resulting in an increase in the PMI share to 36 percent for 2013 (41 percent in the fourth quarter of 2013). This was accompanied by a corresponding decrease in the FHA share.

The better deal depends on credit scores

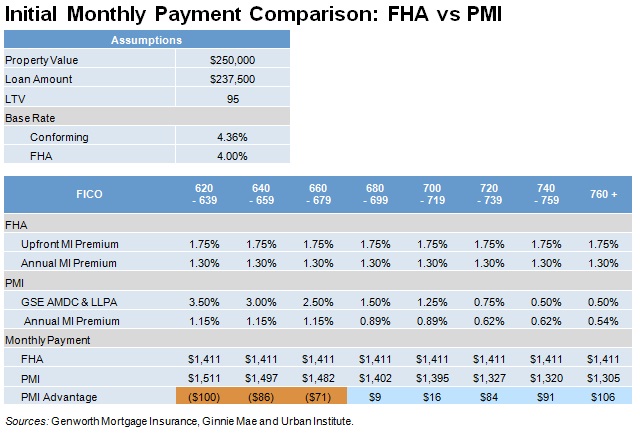

This month, we have expanded the mortgage insurance activity section of the chartbook to include a comparison of the monthly payment on a 95 LTV FHA loan and on a similar loan purchased by Fannie Mae or Freddie Mac, with private mortgage insurance (top of figure below). An FHA borrower pays the basic FHA mortgage rate (in the range of 4.0 percent), as well as an upfront premium of 175 basis points (bps) and an annual premium of 130 bps. (The premium is 135 bps for loans over 95 LTV; a history of the FHA insurance premiums is contained on the top section of page 33 of the chartbook.) In comparison, a high LTV borrower whose loan is sold to the GSEs pays the interest rate that would be applicable to a pristine borrower (in the range of 4.375 percent), plus the loan level pricing adjustments (LLPAs) imposed by the GSEs (these vary by credit—FICO—score, and are shown on page 20 of the chartbook) and the mortgage insurance premium (which depends on both the amount the borrower is putting down and the borrower’s FICO score). Note that both the LLPAs and the private mortgage insurance premiums vary by FICO score, while the FHA premiums do not.

The bottom section of the table shows the payments on an FHA loan and on GSE loans with mortgage insurance for borrowers taking out a $237,500 mortgage on a $250,000 house (95 LTV) who have different FICO scores. The private mortgage insurance premium rates, as well as the calculation methodology, were obtained from Genworth Mortgage Insurance. The FHA payment is $1411 at all FICO levels. The payment on a GSE mortgage for a 660-679 FICO borrower would include a 2.50 percent LLPA, translating into 50 bps per annum, and an private mortgage insurance annual premium of 115 bps, for a total payment of $1482/month. This is $71 more than the borrower would pay on an FHA loan.

At the other end of the credit spectrum, the payment on a GSE mortgage for a 720-739 FICO borrower would include a 0.75 percent LLPA, translating into 15 bps per annum, and a private mortgage insurance annual premium of 62 bps, for a total payment of $1327/month, $84 less than the FHA loan. Moreover, conventional borrowers can drop PMI coverage when their mortgage pays down to 78 LTV; as of June 3, 2013, FHA borrowers cannot do so, providing another reason for some potential borrowers to favor a GSE loan, even with the cost of private mortgage insurance.

At current FHA and PMI insurance rates, an FHA loan is less expensive than a GSE loan with PMI for borrowers with lower FICO scores. But for borrowers with higher FICO scores, a GSE loan is less expensive. Since 2009, FHA mortgage insurance premiums have risen faster than LLPAs and PMI. The result is that more high LTV borrowers with high FICO scores have found that a GSE loan with private mortgage insurance is more favorable than an FHA loan, fueling the growth of the PMIs. Short of a substantial increase in GSE guarantee fees or LLPAs, or a change in the structure of FHA insurance, we believe the PMIs will continue to grow their market share.

Let’s build a future where everyone, everywhere has the opportunity and power to thrive

Urban is more determined than ever to partner with changemakers to unlock opportunities that give people across the country a fair shot at reaching their fullest potential. Invest in Urban to power this type of work.