A version of this post originally appeared on Redfin.

If you can afford a monthly mortgage payment but don’t have the required 20 percent down payment, you have two loan options: a Federal Housing Administration (FHA) loan or a conventional mortgage guaranteed by the government-sponsored enterprises (GSEs). Both programs allow borrowers to put as little as 3.5 percent down, but is one a better deal than the other?

For the past 15 months, the answer has been the FHA loan. But for those with nearly perfect credit, a change to private mortgage insurance (PMI) fees in April 2016 made the GSE guarantee more affordable. This new pricing could pull some of the highest-quality borrowers out of FHA and into GSE loans.

Under old PMI pricing, FHA was a better deal, regardless of credit score

When FHA cut its annual premium by half a percent at the beginning of 2015, private mortgage insurers faced tough competition. For a borrower with a $250,000 home and a 3.5 percent down payment, an FHA loan offered a more affordable monthly payment than a conventional loan. Over the past 15 months, even borrowers with pristine credit would pay almost $100 more per month through a conventional loan than through an FHA loan.

PMI lost market share to FHA in 2015

The low FHA premiums drove the administration’s market share to 40 percent of all mortgage insurance in 2015, up from 34 percent the previous year. PMI’s share declined from 40 percent to 35 percent in the same period. This reversed the trend from 2010 to 2014, when PMI had been steadily picking up market share as FHA premiums rose several times before the 2015 cut.

Under new PMI pricing, the better deal depends on credit scores

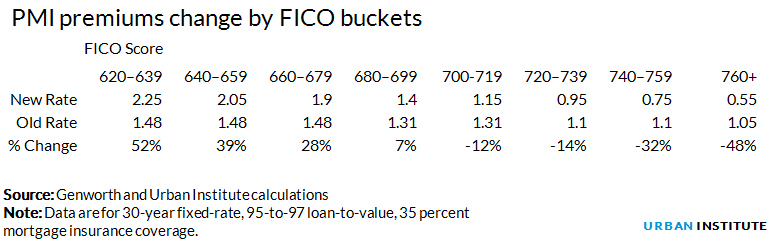

The recent private mortgage insurance price reduction lowers premiums for borrowers with credit scores of 700 and above and raises rates for borrowers with lower scores. For borrowers with FICO scores of 700 and above, the reduced PMI premiums will deliver between $30 and $101 in monthly savings. Many of these borrowers, who previously would have opted for FHA loans, may now find conventional loans more attractive.

For borrowers with the highest credit scores (760 and above), the conventional loan payment fell sharply to $1,268, $5 less than an FHA loan. For borrowers with scores from 740 to 759, the conventional loan remains more expensive than the FHA loan, but the gap has shrunk substantially from $106 to $30. Moreover, borrowers stop paying private mortgage insurance once the remaining balance on the mortgage is down to 78 percent of the home’s value, but FHA’s annual premium never goes away, providing another reason for potential borrowers to favor conventional loans, even with a slightly higher monthly payment.

For borrowers on the lower end of the credit spectrum, the higher PMI rates make conventional loans even less attractive than before. This preference could add to FHA’s adverse selection, in which borrowers with lower FICO scores disproportionately gravitate to FHA financing over conventional loans with PMI.

The new private mortgage insurance pricing will likely increase the GSE share of low down–payment, high-credit borrowers. The overwhelming majority of FHA borrowers make down payments between 3.5 and 5 percent. Of these, 32 percent have FICO scores above 700—the range where the PMI premium is decreasing. Nearly 12 percent have FICO scores above 740 and may now find GSE execution to be more attractive. While the number of borrowers who will now choose the GSE mortgage over the FHA mortgage remains to be seen, we would expect it to be small but noticeable.

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.