<p>A real estate sign is shown in a Detroit neighborhood. Hammered by the automobile industry's decline, Detroit's population plummeted 25 percent over the past decade amid an economic downturn so severe that Michigan was the only state that failed to gain residents, according to 2010 Census data released Tuesday. (AP Photo/ Paul Sancya)</p>

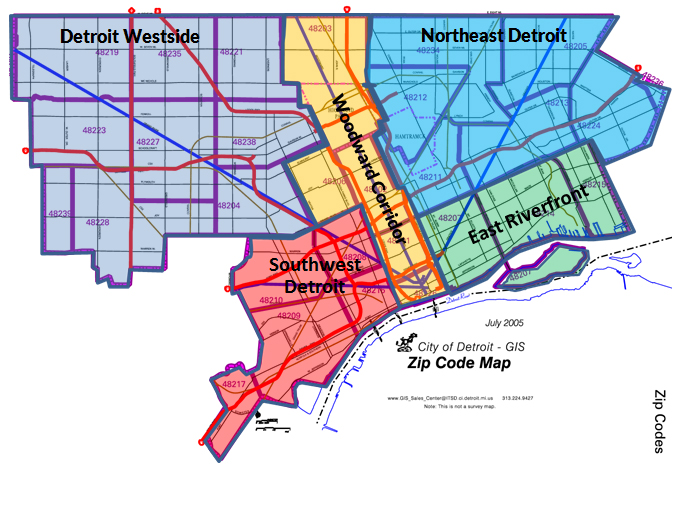

Since Detroit filed the largest municipal bankruptcy in US history in 2013, many state and local stakeholders have sought to use the city’s massive financial challenges as an opportunity for rebirth. The city still faces very real problems: population decline, fiscal insecurity, a weak housing market, and blight. While there is not yet consensus on Detroit’s path forward, a wide range of stakeholders, including philanthropy, business, nonprofits, and the public sector have invested significant resources (and brainpower) to restore prosperity to what was once the fourth most populous city in the United States.

Repairing Detroit’s housing market is a key component in this recovery plan. To build the evidence base around the city’s recovery and bolster revitalization efforts, our quarterly Detroit Housing Tracker captures the local housing market’s dynamism and developments.

Over the past year, certain parts of the city and housing market have rebounded. The data in the latest edition of the tracker, released today, reveals that home prices are up and delinquency rates are down in a continued yet uneven housing recovery.

Home prices are on the rise

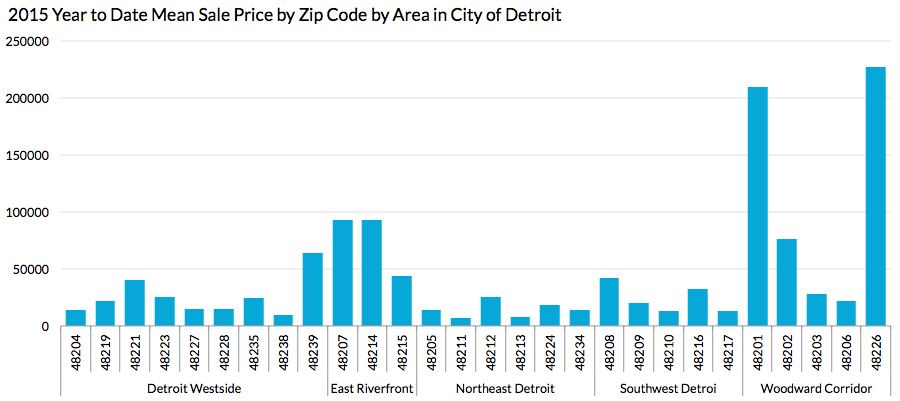

Home prices in the city of Detroit are rising but remain historically low, with overall prices up 19 percent in the first three quarters of 2015 compared with the same period in 2014.

Since 2011, the East Riverfront and the Woodward Corridor have experienced the largest increases in home prices. Mean sale prices within these two areas are by far the strongest. While home prices in East Riverfront and Woodward Corridor have been consistently strong since 2007, the disparity between those areas and northeast, west, and southwest Detroit has grown considerably. Northeast Detroit, in particular, has lagged behind all other areas since the housing crisis began.

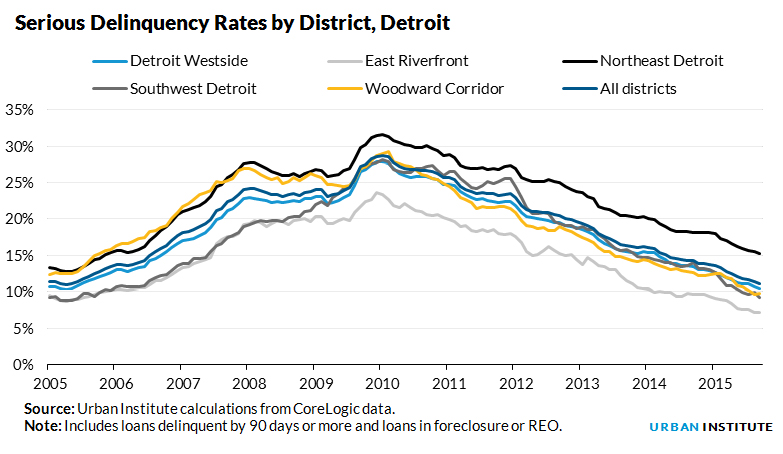

Delinquency rates are down

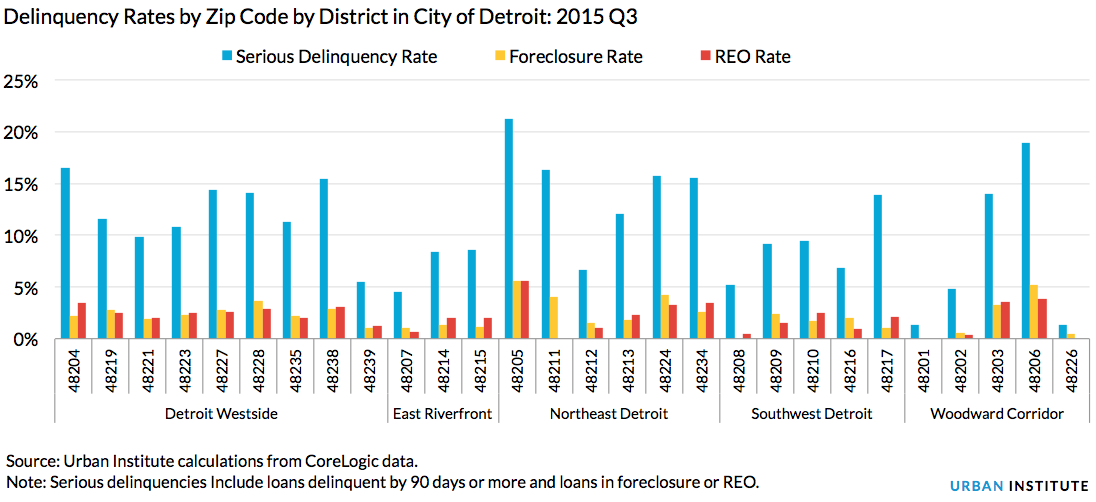

The reduction in delinquency rates (measured as the share of mortgages that are in foreclosure, real estate owned, or delinquent for 90 days or more) mirrors the improvements in home prices. In September 2015, overall delinquency rates stood at 11.9 percent, down 22 percent from September 2014 and on pace to drop below pre-crisis levels. While delinquency rates in East Riverfront never rose as much as in the rest of the city, Woodward Corridor’s rates have quickly dropped below the city average since peaking in 2010.

In contrast, the delinquency rates in northeast Detroit have stayed considerably higher than the rest of the city in recent years. Northeast Detroit is currently the only area out of the five that has higher delinquency rates than the city average.

Even within neighborhoods, recovery is uneven

Some zip codes performed better than others, even in the prosperous East Riverfront and Woodward Corridor. In Woodward Corridor, the average home sells for over $200,000 in zip codes 48201 and 48226, while zip codes 48203 and 48206 are well under $30,000, below the $44,000 city average. In East Riverfront, the mean sales price in zip code 48215 is less than half of that of the other two district zip codes.

Delinquency rates show a similar story. In Woodward Corridor, the zip codes with the highest home prices (48201 and 48226) exhibit the lowest delinquency rates. These differences may well persist below zip codes, as some quickly recovering neighborhoods are very close to those that are still struggling.

With home prices up and delinquency rates down, the Detroit housing market continued to improve slowly in 2015 with quickly recovering areas close to areas that continue to struggle.

Every neighborhood is different, requiring the city and its partners to adjust revitalization efforts to fit the unique opportunities and challenges of individual communities. As new products and approaches come online, market actors can increasingly target micro-market conditions. In addition to these tailored programs, developing more market-wide solutions will be essential to attracting additional investment and bringing the city’s recovery to scale.

This blog post and the accompanying housing market tracker are part of a portfolio of Urban products focused on Detroit. These products are funded as part of a broader collaboration with JPMorgan Chase. Urban researchers are working with JPMorgan Chase to inform and assess the firm’s philanthropic initiatives aimed at expanding economic opportunity. This includes JPMorgan Chase’s $100 million, five-year commitment to support and accelerate Detroit’s economic recovery. Learn more about Urban’s collaboration with JPMorgan Chase here.

Let’s build a future where everyone, everywhere has the opportunity and power to thrive

Urban is more determined than ever to partner with changemakers to unlock opportunities that give people across the country a fair shot at reaching their fullest potential. Invest in Urban to power this type of work.