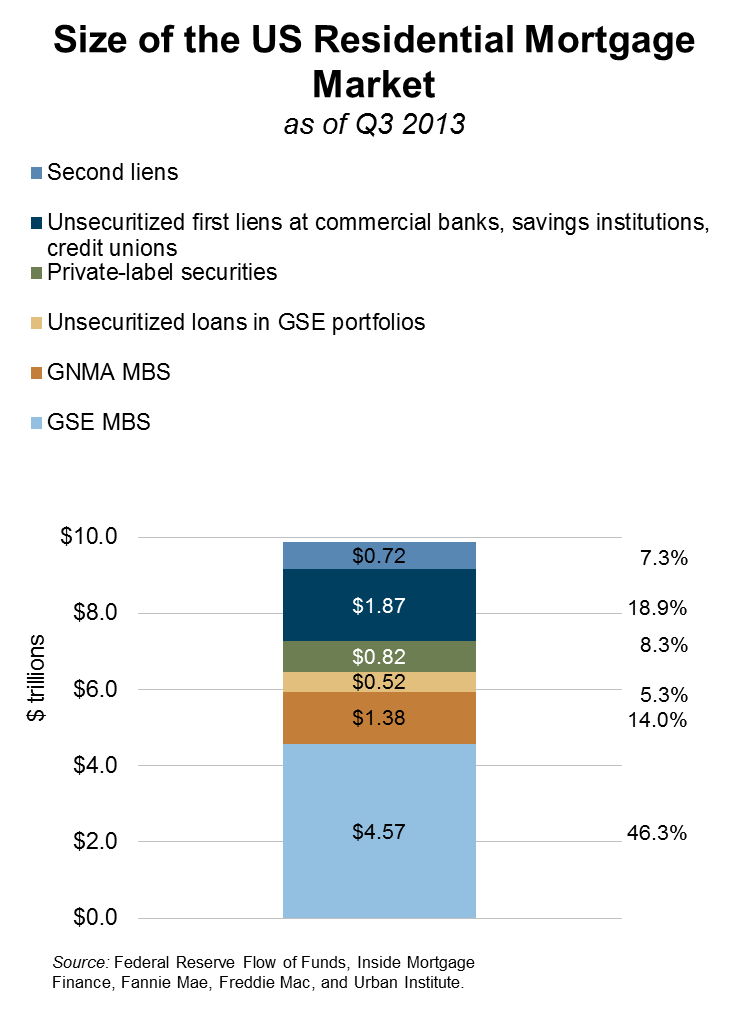

Among the many reasons for reform of the housing finance system, one of the more conspicuous concerns is taxpayer risk. In 2008, Fannie Mae and Freddie Mac were put into conservatorship because they were too big to fail. Their government guarantee went from implied to explicit. Together with other forms of government-guaranteed mortgage debt, the government now backs about 80% of new mortgage loans.

How can we move back to a system in which private capital absorbs more credit risk? At Tuesday’s Sunset Seminar, a series co-hosted by the Urban Institute’s Housing Finance Policy Center (HFPC) and CoreLogic, HFPC’s Laurie Goodman and other panelists weighed in on the future of private capital in the housing market, focusing on what it would take to bring back private-label mortgage backed securities (PLS). The panel was moderated by Faith Schwartz of CoreLogic.

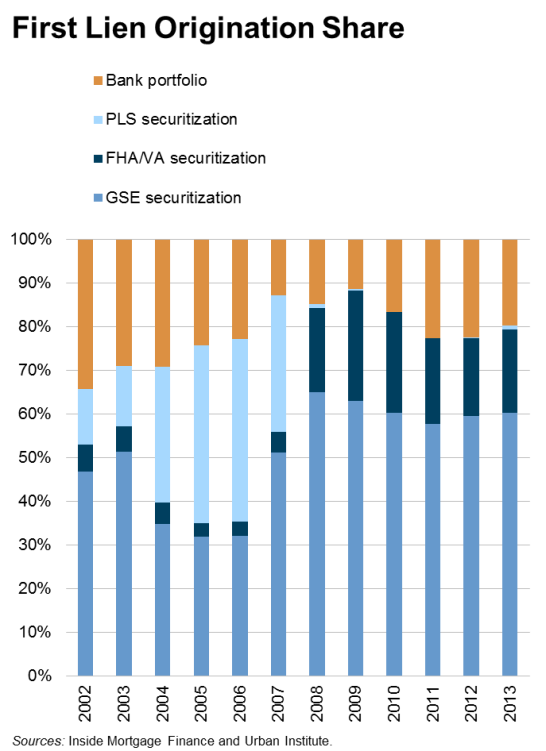

During the early part of the last decade, both Fannie and Freddie provided a stable portion of the mortgage originations. Meanwhile, PLS was steadily expanding, peaking at 41.9 percent of total originations in 2006. Its share dramatically contracted after the crash; only 1 percent at the end of 2013. What will it take to bring more private investors into the market? In Goodman’s words, “we’re a long way off.”

|

Investor challenges and shrinking of the GSE footprint

Panelist Paul Leonard of the Financial Services Roundtable noted that “there’s a general uncertainty about where we’re going.” Lenders and investors are still unclear about the direction of housing finance reform and are unsure when to expect concrete change. Additional issues such as the Qualified Mortgage rules and reps and warrants further obscure the future, making lenders hesitant to increase lending, especially beyond borrowers with the most pristine credit.

Panelist Eric Kaplan of Shellpoint Partners emphasized the need for transparency and some degree of standardization of PLS. He described Project RMBS 3.0, which will bring together investors, rating agencies, trustees, due diligence firms and others to set benchmarks, establish best practices and develop means to make deviations from standards transparent. Results are expected starting in about six months. To fellow panelist John Vibert of Blackrock Advisors, RMBS 3.0 is a promising start, but much more needs to be done to overcome the distrust built up through the bust and get investors back into the market at scale.

Price is also holding back the PLS market. Panelist Trez Moore of Royal Bank of Scotland noted that because investor demand for PLS is low, especially for the AAA tranches, sales of whole loans to banks are more profitable for originators.

Risk-Sharing

While the PLS market has been moribund, the GSEs have been laying off credit risk through risk-sharing transactions, bringing investor capital in without contracting the government footprint. In these transactions, the GSEs sell bonds whose performance is governed by the performance of a pool of GSE loans. The reference pools for the risk-sharing transactions to date consist of loans with an average FICO score of 761-765 and loan to value ratio (LTV) of 72-75 percent. As Goodman noted, this is even more pristine than today’s typical GSE loan, which averages a FICO of 757-761 and combined LTV of 78-79 percent. Since last July, Fannie has done two transactions and Freddie three, sharing the credit risk on $56 billion and $89.9 billion of loans respectively. In Goodman’s opinion, if the GSEs are to share a significant portion of the risk on their books, they will need to make deals with lower quality loans. Panelists Kaplan and Moore were skeptical whether these deals would sell.

In light of the potential cost to consumers of bringing more private capital, especially beyond bank capital, into the market, one member of the audience of 70 asked, “if [it] is going to be this costly, is that really what we want?” Both the market and the political system will determine the answer.

Photo by Gene J. Puskar/ AP

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.