In fiscal year 2011 the federal government spent $286 billion to subsidize the purchase of employer-based health insurance, making it the largest tax expenditure on the books. Over the next 10 years, this subsidy will cost $3.6 trillion.

Did Congress ever vote for this big health care tax subsidy? Did the president ever sign it into law? The simple answer is no.

This massive, unintentional federal subsidy came about when employers sought to avoid the wage and price controls, and high taxes on corporate profits imposed during World War II.

Since health insurance benefits were exempted from these measures, employers began shifting more of their employees’ compensation in the direction of health benefits.

But these days, with the federal debt soaring, lawmakers are on the hunt for new ways to curb the deficit. And since this tax exclusion is by far the largest federal tax expenditure, they may turn to it as a potential source of federal revenue.

While this tax break is a huge drag on federal revenues, an equally important concern is that it is regressive. In other words, the exclusion reduces taxable income by the percentage a taxpayer owes, so it is more valuable to high-income earners than it is to those further down the spectrum.

For example, an untaxed $10,000 premium saves a taxpayer in the 35 percent tax bracket about $3,500. But for a taxpayer in the 15 percent bracket, it only reduces the tax bill by about $1,500.

Completely eliminating this tax exclusion might destabilize employer-sponsored health insurance. This is where the majority of Americans get their coverage, so Congress is not likely to make such a drastic change.

However, reducing the tax break by a modest amount has the potential to raise revenue AND make it a little fairer.

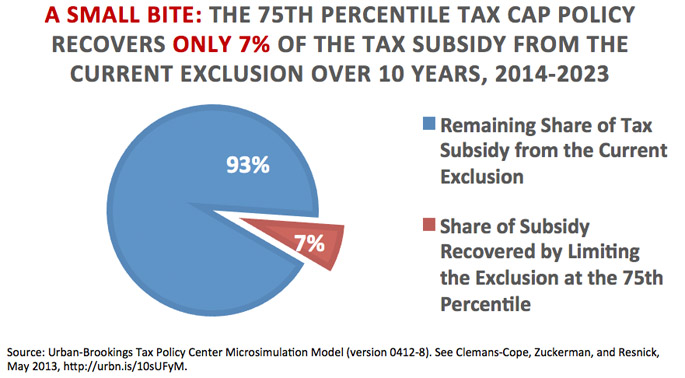

To see if a modest policy change could achieve these goals, Urban Institute researchers ran a simulation that imposed a dollar limit on the total cost of employer-sponsored health coverage that could be excluded from income and payroll taxes.

In the model, income and payroll taxes were applied to the portion of premiums and medical benefits that exceed a cap set at the 75th percentile in 2013. That’s about $6,500 for employee-only coverage and roughly $18,000 for family coverage.

The simulation also allowed the cap to grow over time, by a five-year average of the rate of GDP growth.

With these assumptions, the researchers found that:

- Roughly 93% of the current tax exclusion would be untouched over the next 10 years;

- High-income taxpayers would face larger tax increases than people with lower incomes, reflecting the progressive nature of the tax code;

- Most taxpayers would be unaffected: after ten years, the share of taxpayers paying higher taxes would increase to just 20 percent.

However, other factors deserve consideration as well. Looking more closely at how the distribution of premiums relates to employees’ characteristics, the research tells us that:

- Public-sector employees often have higher premiums than private-sector employees, and thus would be more likely to be adversely affected by a 75th percentile cap.

- Employees at firms with a union who receive employee-only coverage would be more likely than average to feel the effects from this cap.

- Workers at these same types of firms who have other types of coverage would not be much more likely than average to see increased taxes.

- Employees in financial and other professional industries are much more likely to see increased taxes than those working in other fields.

Overall, our study told us that carefully crafted legislation can limit the tax exclusion of employer-based health insurance premiums and medical benefits in a way that helps improve the nation’s fiscal problems and simultaneously moves toward a more equitable distribution of this tax expenditure.

Paycheck image from Shutterstock

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.