COVID-19 poses a great threat to public health and, with widespread business shutdowns, to the health of the economy. These effects hit employees of location-dependent businesses the hardest, including entertainment, travel, retail, and manufacturing businesses. And many of these employees are hourly workers who are more likely to be renters.

On the policy side, quick action has been taken to help homeowners. Fannie Mae, Freddie Mac, and the Federal Housing Administration have barred evictions and foreclosures for 60 days, and Fannie Mae and Freddie Mac have announced that the more flexible forbearance policies applying to natural disasters will apply to this crisis.

Though individual localities have eviction moratoria in place, federal help for the country’s 44 million renters, including the 21 million already cost burdened, has been limited. Fannie Mae and Freddie Mac have announced they will provide up to three months of mortgage deferral for multifamily homeowners with government-sponsored enterprise mortgages (subject to hardship documentation and lender approval), and, in return, the landlord must agree not to evict tenants for nonpayment of rent. It is unclear how many landlords will take advantage, as the money must be repaid within a year.

This is not nearly enough to ensure renters can remain in their homes. As shown by our analysis of data from the 2018 American Community Survey, the 2018 Survey of Household Economics and Decisionmaking, and the 2019 US Financial Health Pulse, renters are particularly vulnerable to hardship, and the pandemic will increase that vulnerability. Proactive, comprehensive action is needed quickly.

Why renters are financially less well positioned to weather the crisis

Renters have lower incomes: Their median income in 2018 was $40,531 compared with $78,045 for homeowners.

Renters have smaller or no rainy day funds: Many struggle to find even a small sum for a small emergency: 21 percent of renters said they could not come up with $400 for an emergency in 2018, compared with 5 percent of homeowners. And even 15 percent of renters who rarely or never struggled to pay rent said they could not come up with $400 for an unanticipated emergency.

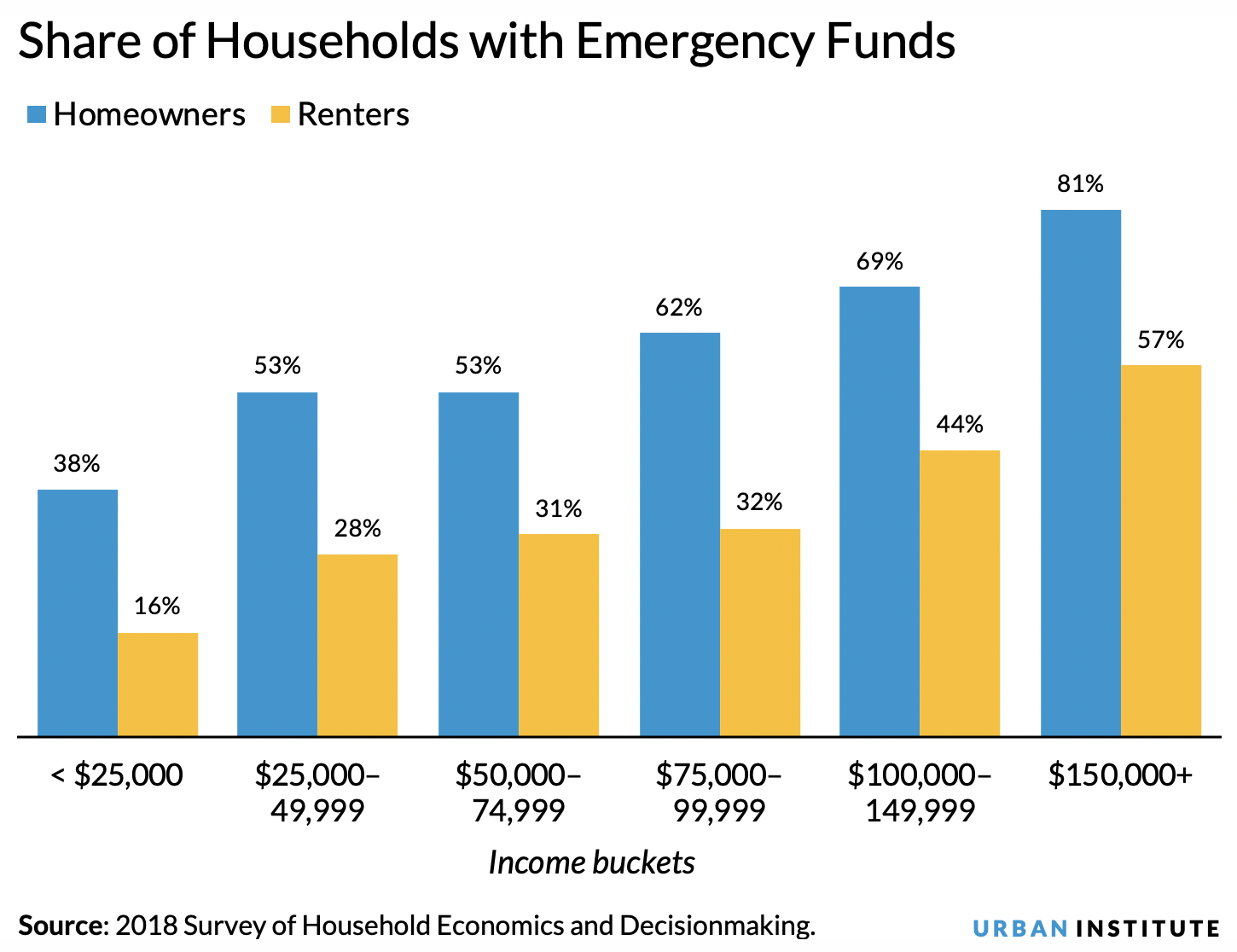

As of 2018, more than half of all homeowners (63 percent) and just less than one in three renters (31 percent) had enough money set aside for a three-month emergency, such as an extended sickness, a job loss, or an economic downturn.

Even renters with the same incomes as homeowners are less prepared to weather a three-month crisis—38 percent of homeowners, but just 16 percent of renters, with incomes of less than $25,000 have emergency funds that could carry them for three months.

Renters have less access to credit. Thirty-three percent of renters have no or poor credit scores, compared with 10 percent of homeowners. Almost half (46 percent) of renters don’t have a credit card, compared with just 14 percent of homeowners. This means many renters will have trouble finding additional financial resources if needed.

Renters have lower job and income stability: We find a clear connection between renters’ struggles to pay their housing costs and their higher income variability. Fifteen percent of those who had difficulty paying rent experienced high month-to-month income variation. Of those who rarely or never had difficulty with their payments, fewer than 8 percent had variable incomes.

Unemployment is also directly related to ability to meet housing costs. Our analysis shows those who sometimes or often faced difficulty paying rent were more than twice as likely to be unemployed than those who rarely or never had trouble with paying rent.

Historically, renters have struggled more than homeowners to pay for housing

Even in better economic times, renters faced greater challenges paying for housing. In 2019, 27.0 percent of renters often or sometimes struggled to pay their rent, more than three times higher than the 7.8 percent of homeowners who struggled to pay their mortgage.

The share of renters—who, again, on average, have lower incomes and less savings, access to credit, and job stability than homeowners—who will have trouble paying for housing is expected to increase substantially as our economic conditions deteriorate. Unemployment has been running at 3.5 percent; the consensus forecast is an increase to 12–15 percent in Q2, with some estimates as high as 30 percent. And this increase is likely to disproportionately affect renters.

What should we do right now?

To use a cliché that has never been more apt: extraordinary times call for extraordinary measures.

Temporary eviction relief, even if widely available, is inadequate because the renter still owes the money and cannot make up lost wages.

By forcing landlords to temporarily halt evictions, we are simply passing along a significant financial burden that could put landlords—who are mostly small-business owners—out of business for good. If not addressed, this could lead landlords to cut costs by reducing services and maintenance, which could lead to unsafe rentals.

If landlords become even more stressed by the burden of an eviction moratorium, they will be forced to sell properties. If enough of these sales happen at the same time, it could flood the market and trigger a real estate crash.

The only solution is to use government funds to provide rental assistance that provides direct and immediate relief to both renters and landlords.

We need a program; only the details remain to be discussed. The discussion should center on who should be covered (for example, income restrictions and documentation of hardship), the form this program should take (voucher payments to tenants or a program for landlords), and coverage caps (maximum amount per month per unit, income caps on borrowers and length of the program).

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.