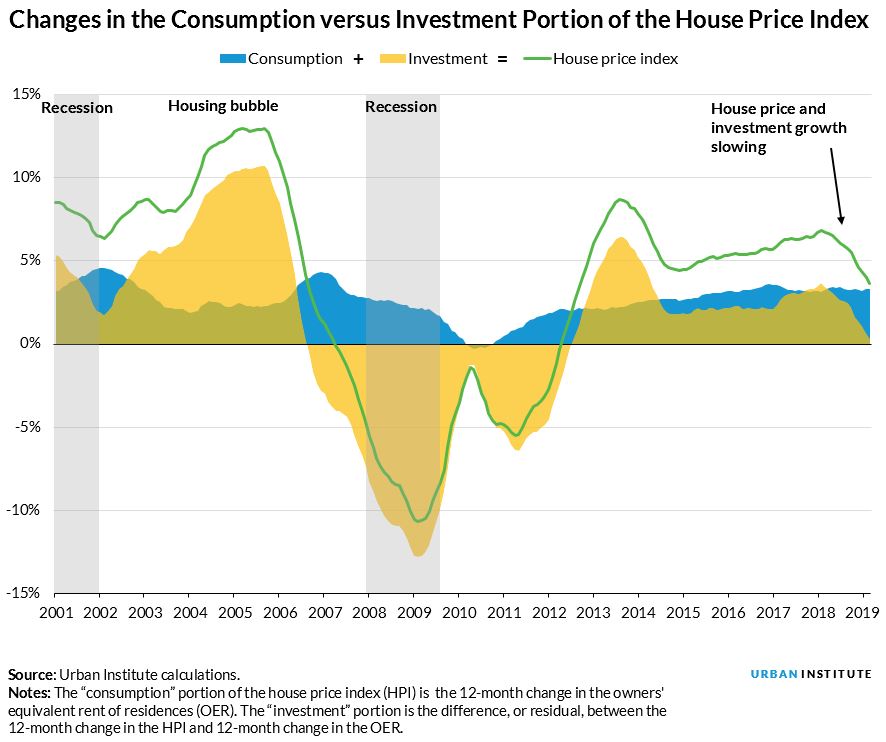

Following the collapse of the housing market around 2008, many worry that we will enter another housing bubble. But our most recent chartbook shows that the current demand for houses is largely driven by families seeking to purchase homes and not by speculators, suggesting healthier housing market conditions.

We can better understand demand for housing by breaking the Black Knight house price index (HPI), found on page 22 of our May chartbook, into two components:

- families’ desire for a place to live, or to “consume” housing

- buyers’ desire to benefit from long-term buildup in equity, or to “invest” in housing

Growth in the HPI essentially reflects these two variables: appreciation caused by demand for housing both as a consumable good and as an investment.

The consumption portion of the HPI can be estimated using the owners’ equivalent rent of residences (OER), a component of the consumer price index produced by the Bureau of Labor Statistics. In simple terms, the OER is the amount the owner would pay to rent a similar home.

Calculating changes in the OER allows us to isolate the consumption portion of HPI growth because renters are looking to satisfy only the consumption part of housing and don’t have investment gains. The residual (i.e., the difference between the HPI and the OER) reveals how much home prices have increased because of an increase in just the investment value.

House prices appear to be losing momentum

During the housing bubble of the early 2000s, growth in the investment component of HPI was substantially larger, reflecting reckless lending and speculative homebuying. The collapse immediately resulted in a steep decrease in investment returns from housing.

Investment-driven demand for housing returned in 2012 as buyers with strong credit profiles and deep pockets snapped up millions of foreclosed homes at rock-bottom prices. Not surprisingly, peak growth of the investment component in 2013 (4.2 percent) far outpaced the consumption component (2.2 percent), although to a lesser extent than during the bubble.

Over the past year, house price growth has steadily slowed. According to Black Knight, house prices rose 3.6 percent from March 2018 to March 2019, nearly half of the 6.8 percent increase between February 2017 and February 2018. The current increase in the HPI is in line with the 3.3 percent growth in the March OER.

The change in the investment portion of the HPI (0.3 percent) is currently quite small. In other words, a family buying a home at today’s prices will do slightly better than inflation, but they shouldn’t expect outsize equity gains.

With nationwide house prices at historic highs in nominal terms, the potential for investment returns from homeownership has been significantly reduced. Faced with these trends, families making the decision to own or to rent today should also consider the absolute cost of owning versus renting, including maintenance costs, taxes and insurance, and foregone interest on the down payment. They should also consider that homeownership provides a hedge against future housing inflation or rent increases.

More importantly, these data should comfort those worried about another housing market crash. Compared with the 2005–2007 bubble, when the HPI was driven mostly by speculative buying, the HPI today is driven mostly by families wanting to buy homes to live in.

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.