Millions of students at colleges and universities across the country are facing an unprecedented moment of financial and educational uncertainty as campuses move online in response to the COVID-19 pandemic. These students are more likely to be from low-income backgrounds than students during the 2008 recession, and many will need support not only from their institutions but also from the broader safety net.

As we have recently documented using Virginia as a case study, students may piece together funds for tuition and costs of living through work, social safety net benefits such as the Supplemental Nutrition Assistance Program (SNAP), and grant aid from federal, state, and institutional sources. The recent crisis puts into stark relief the fragility of this system for the students with most need.

How much financial insecurity do students face?

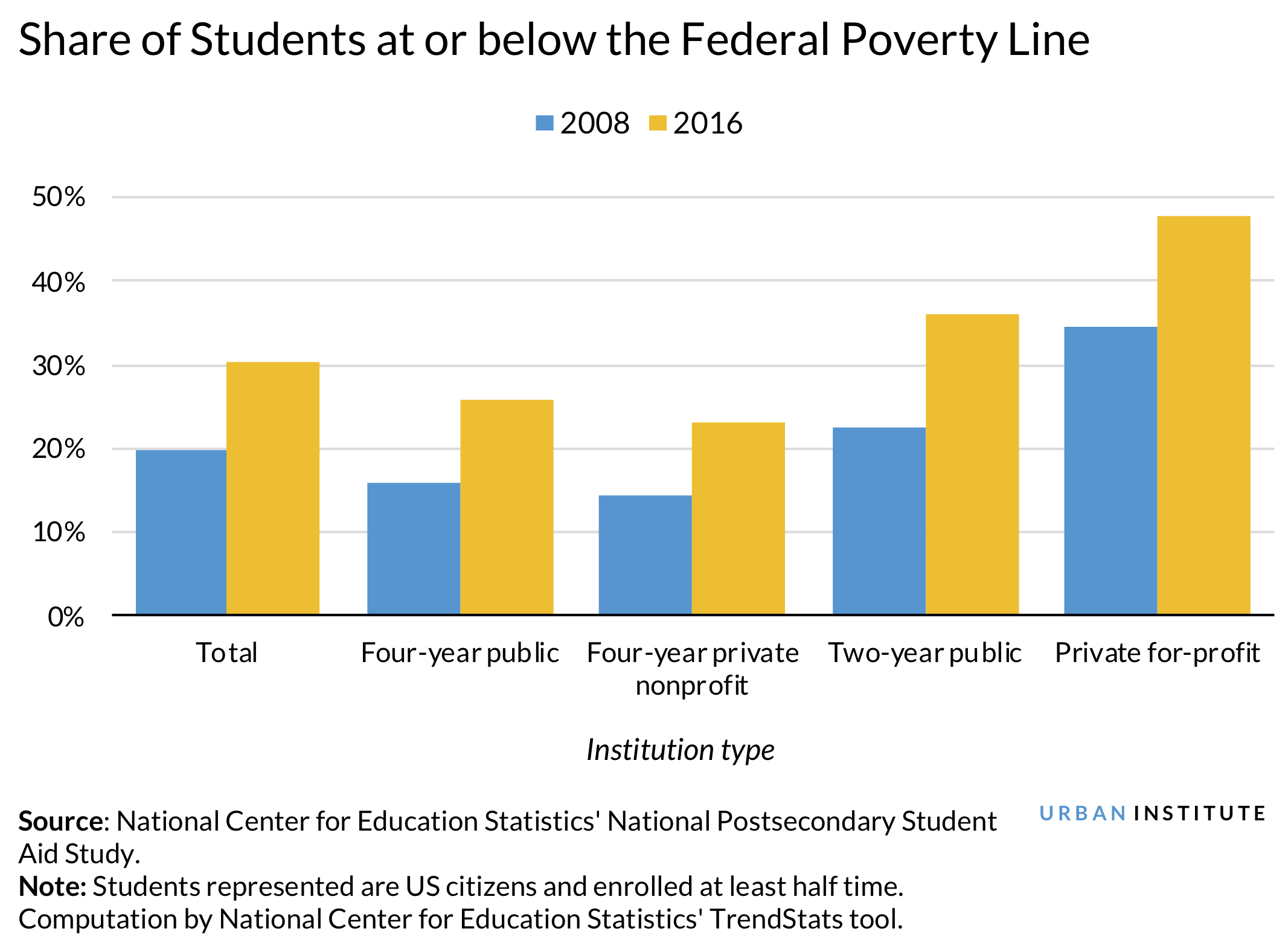

A larger share of students in the 2015–16 school year (the most recent year for which data are available) had family income at or below the federal poverty line than in 2007–08, before the Great Recession. Public two-year and private for-profit institutions, on average, have a larger share of students in poverty than public and private nonprofit four-year institutions.

Looking at data from last year (2018–19), the share of students receiving Pell grants (an award for undergraduates on the basis of financial need) was 5 percentage points higher than in 2008–09, 31 versus 26 percent. Although this change reflects changes in Pell eligibility as well as a more economically diverse student body, it suggests the current population of students may be more vulnerable to a financial crisis than in 2008. Considering that low-income communities were hardest hit by the Great Recession and have yet to recover relative to higher-income communities, a larger-scale response may be required to support students with financial need.

Institutions have multiple options for identifying students in need

The recently passed Coronavirus Aid, Relief, and Economic Security (CARES) Act mandates that at least half the $14 billion allocated to institutions go to emergency aid for expenses students incurred because of disruptions to campus operations. The CARES Act gives colleges flexibility in how to disburse this aid. In normal circumstances, financial aid administrators determine students’ financial need using the Free Application for Federal Student Aid and other financial aid forms. In the wake of the economic downturn, however, these forms become obsolete for some students. Students whose need has changed may not know they are eligible for additional help.

Colleges can take several approaches to identity and verify the circumstances for students who are currently most in need of emergency aid:

- Use state notifications and data: In the 2008–09 recession, colleges used unemployment letters to provide changes in financial aid through the “Professional Judgement” process. Today, colleges could work with states to notify those who applied for unemployment that they may be eligible for changes in financial aid, or, to the extent possible, use links to state administrative data, like unemployment records or SNAP receipt, to identify students and families most in need.

- Identify students who held on-campus jobs or used on-campus resources: Students who relied on on-campus opportunities, such as child care, TRIO programs, or on-campus jobs, may have particular need. Through the CARES Act, federal work-study (FWS) aid has been extended, but about 10 percent of working students hold non-FWS on-campus jobs. Colleges can ensure that students who have seen a substantial change in income or support services from campus closures are given the opportunity to apply for emergency aid.

- Use information on broadband internet access: Emergency aid could be used to support students in acquiring technology to access their coursework. The Federal Communications Commission has a tool that provides address-specific information on the availability of broadband internet, which may provide colleges with information about which students need help getting online.

Undocumented and international students will likely need support as well, but it is unclear if the emergency aid provided by the CARES Act can be delivered to these students. Institutions might have to rely on their own funds or donation-based emergency aid to help these students.

Policymakers can support food security for students, especially those at two-year schools

Two-year college students were much more likely than other adults to experience food insecurity in the wake of the 2008 recession. In Virginia, about 7 percent of community college students rely on SNAP, though SNAP restrictions limit use by students. Although institution-level supports could be helpful, these students might also need support from the social safety net.

Generally, students enrolled at least half time are not eligible for SNAP benefits unless they meet certain conditions, such as working at least 20 hours per week or caring for a dependent under 6 years old. The Families First Coronavirus Response Act suspends work requirements for other adults on SNAP and provides recertification flexibility, but it does not change student requirements.

To help students currently relying on SNAP, policymakers could do the following:

- Maintain the SNAP status of currently enrolled students: Flexibility on recertification will help keep students on SNAP during this time of uncertainty. But for those who are eligible through working 20 hours a week or through federal work study, additional steps may need to be taken to ensure benefit continuity even as jobs disappear.

- Relax provisions on summer SNAP for students: Students who are continuously enrolled aren’t eligible for SNAP during the summer unless they continue to meet student eligibility criteria. Students intending to continue their education in the fall may feel pressure to leave school to remain eligible for SNAP throughout the summer. SNAP availability for students in the summer could be temporarily expanded, perhaps by using eligibility criteria outlined in the proposed College Student Hunger Act of 2019 (PDF).

College students were among the first to experience substantial change as the nation grappled with the COVID-19 pandemic. In the likely case that students experience economic hardship into the next academic year, colleges and policymakers should consider longer-term solutions to support incoming and returning students. For now, quick actions by institutions and policymakers can ensure students’ immediate needs are met.

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.