As part of President Biden’s first days in office, he has proposed expanding the earned income tax credit (EITC) for workers without children living at home, who are considered “childless” for tax purposes. Democratic policymakers on the Ways and Means Committee have also proposed expanding the EITC but have yet to release details of their plan.

Biden’s EITC expansion, which is included in his larger economic stimulus plan, temporarily boosts the tax credit for childless workers (some of whom are parents without custody of children who live the majority of the year elsewhere). It triples the maximum credit, allows the credit over a larger income range, and allows workers ages 19 to 24 and ages 65 and older to receive the credit.

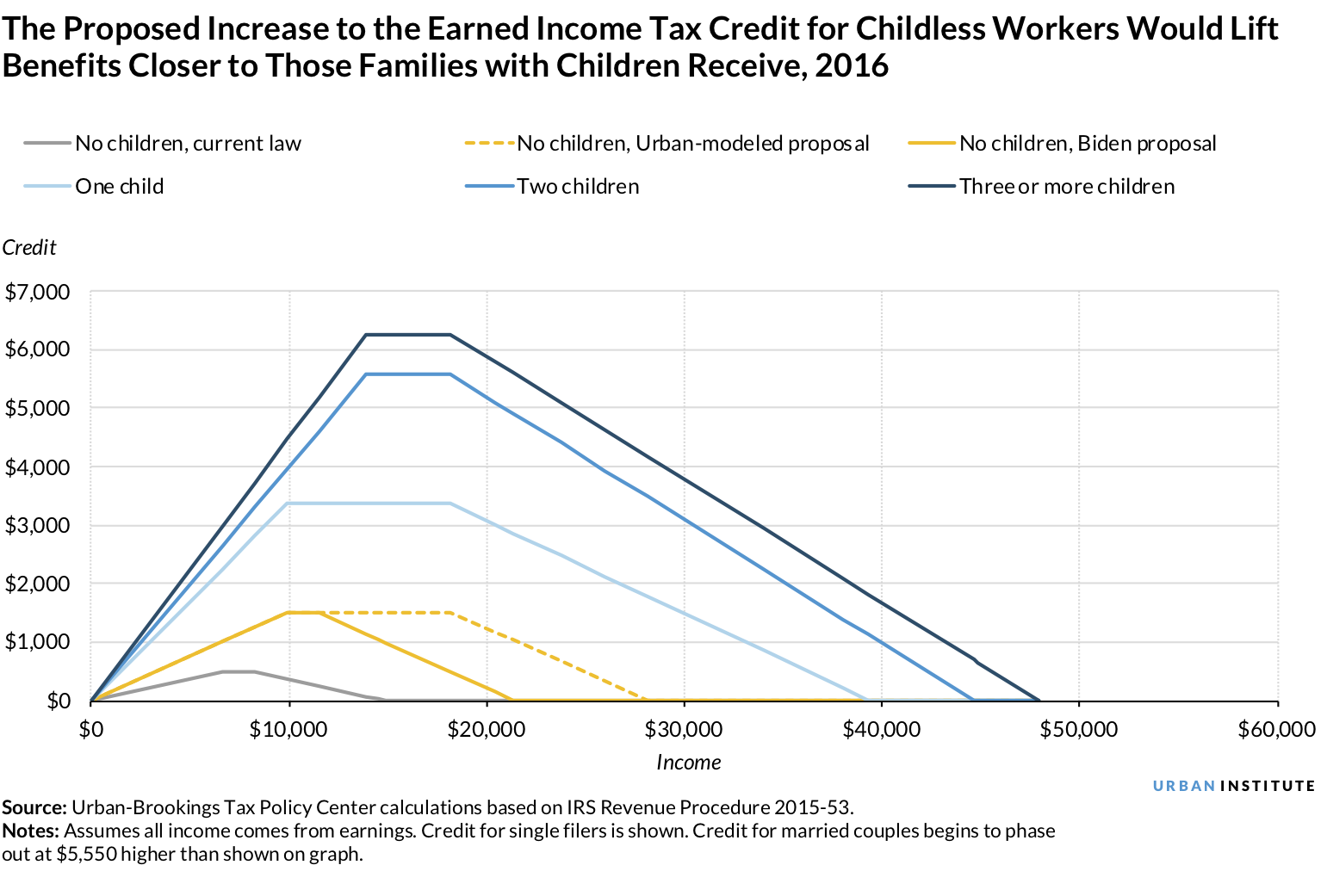

Previously, we modeled a similar expansion of the childless EITC, though the proposal we modeled included paying the credit over a larger income range than what Biden has proposed and reducing the age of eligibility from 25 to 21. In the proposal we modeled, the number of workers who would be eligible for the childless EITC roughly tripled, and after-tax incomes increased by about $1,000 annually. But in either case, expansion of the EITC would allow childless workers to receive critical income support and would improve equity between families with children and those considered childless.

The EITC currently benefits workers with children more than childless workers

For many low-income workers, the EITC provides a refundable tax credit, meaning those workers can receive the credit, minus their taxes owed, as a tax refund. Families can receive the maximum credit as income increases, but past a certain income level, the credit begins to phase down. The credit rate and the maximum credit depend on the number of children in the family, and larger families are eligible for larger credits.

In the 2021 tax year, childless workers will be able to receive up to $543, which is well below the $5,980 available to a family with two children at home. We used 2016 values to compare Biden plan’s effects against the proposal we modeled, but these values will be different for 2021, as the EITC adjusts for inflation each year.

Our modeling shows that changing the age limits for credit eligibility will do little for most people, if the credit remains small. Tripling the maximum credit, as Biden proposes, could provide substantial assistance to low-income workers, bringing the credit close to half of the credit for workers with one child living at home. Raising the maximum credit would also mean many childless workers would be lifted out of poverty with the EITC, rather than being the only group routinely taxed into poverty by federal income and payroll taxes.

In comparison, the proposal we modeled would achieve the following:

- triple the number of childless tax filers eligible for the EITC, from more than 8 million to more than 24 million

- increase after-tax income by almost $900 dollars annually for those who currently receive the childless EITC and by more than $1,000 annually for all childless EITC recipients if the proposal were implemented

- increase the number of filers with noncustodial children qualifying for the childless EITC from 786,000 to more than 2 million

Overall, the proposal we modeled would increase the total amount of EITC childless filers are eligible for from $2.4 billion to $26 billion, with the share of EITC benefits going to childless workers increasing from around 3 percent to around 26 percent.

Expanding federal and state EITCs can help childless workers recover economically

In addition to the federal EITC, 22 states have a state-level EITC that is a percentage of the federal EITC, so expanding the federal EITC for childless workers would also affect these state-level EITCs. Assuming state policies do not change, nearly nine million people would be eligible for a larger state EITC or be newly eligible for a state EITC, and childless workers would be eligible for an additional $1.4 billion in state-level EITC benefits under the proposal we modeled.

The proposal we modeled lowers the EITC age limit, but keeps the maximum age limit the same. Biden’s plan would extend the credit to older workers as well. Extending the credit to older and younger workers than currently covered could provide critical assistance. Biden’s proposal would exclude full-time students, but independent postsecondary students also need help.

Increasing the size of the credit and the income range could create greater equity between workers with children at home and childless workers, which include some parents whose children live with someone else the majority of the year. By doing so, policymakers would help extend the EITC’s antipoverty effects to a broader group of workers.

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.