Cannabis taxes are levied on legal purchases of marijuana for recreational use.

Although prohibited under federal law, 20 states allow and levy some type of excise tax on recreational cannabis purchases. But different states use different taxes—percentage-of-price taxes, weight-based taxes, and potency-based taxes—and some levy multiple taxes on cannabis. Local governments in 12 states also levy an excise tax on marijuana, but these taxes are almost universally percentage-of-price taxes.

(Note: This page uses cannabis and marijuana interchangeably. See our 2022 report on cannabis taxes for a note on terminology.)

Cannabis taxes are sometimes called a "sin tax" because, unlike a general sales tax, the tax is levied in part to address the negative effects of marijuana use, such as addiction and impaired decision making. (Marijuana has known negative effects and documented benefits.) However, unlike a cigarette tax, a cannabis tax is not typically meant to discourage broad consumption. Instead, some states use revenue from cannabis taxes to fund programs related to the drug or the harmful effects of prior drug law enforcement.

Additionally, some states allow and tax (at low rates) the purchase of marijuana for medical use. However, taxes on the purchase of cannabis for medical use are not considered cannabis taxes.

Where is cannabis legal and taxed and how much revenue do state and local governments raise from cannabis?

As of November 2023, 20 states levy a cannabis tax. This count does not include Delaware, Minnesota, Ohio, and Virginia, states which have legalized recreational marijuana but not yet begun taxable sales. Recreational marijuana use is also legal in the District of Columbia, but Congress prevents the District from regulating and taxing legal transactions.

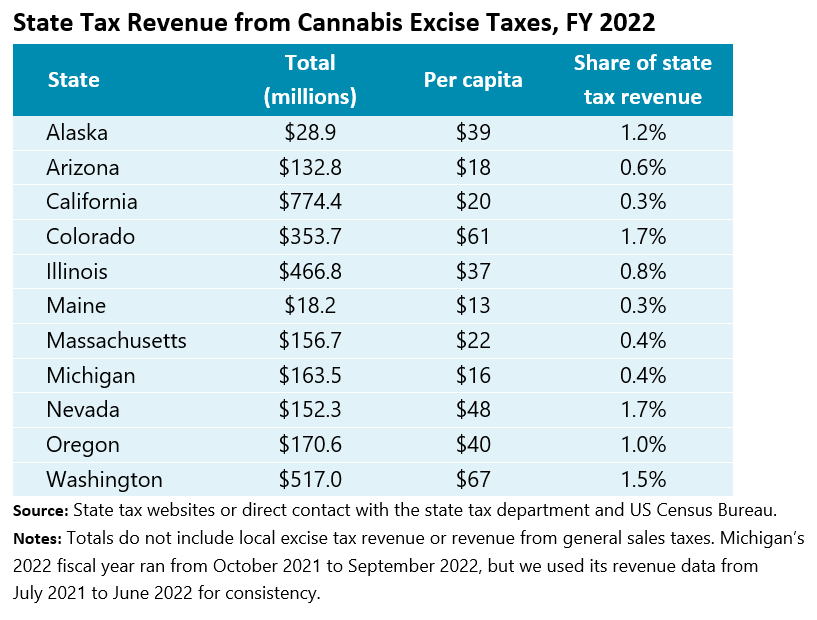

Eleven states collected cannabis tax revenue in all 12 months of fiscal year 2022 (i.e., July 2021 to June 2022), with revenue ranging from $28.9 million in Alaska to $774.4 million in California. Those totals do not include local cannabis taxes (which are not uniformly reported) or collections from state and local general sales taxes (which are not always broken out of a government’s total reported general sales tax revenue).

On a per capita basis in fiscal year 2022, Washington ($67), Colorado ($61), and Nevada ($48) collected the most cannabis tax revenue. Among states with 12 months of collections, Maine ($13) collected the least per capita cannabis tax revenue. (Montana, New Mexico, and New Jersey collected cannabis tax revenue in fiscal year 2022 but not for the full year.) As a percentage of total state tax collections that fiscal year, state cannabis tax revenue ranged from 0.3 percent in California and Maine to 1.7 percent in Colorado and Nevada. Cannabis tax collections provided at least 1 percent of total state tax revenue in Alaska, Colorado, Nevada, Oregon, and Washington in fiscal year 2022.

Although we do not have comprehensive data on local cannabis tax revenue and revenue from general sales taxes on marijuana purchases, the limited data suggest governments are collecting considerable additional revenue from these taxes. For example, in Oregon, the state government levies a 17 percent cannabis tax on the retail price and local governments can additionally levy a 3 percent tax. In fiscal year 2022, the state collected $171 million from its tax and local governments collected an additional $27 million. Meanwhile, in Massachusetts in fiscal year 2022, the state’s cannabis excise tax (10.75 percent) provided $157 million while its general sales tax (6.25 percent) produced another $92 million for the state.

Medical marijuana is legal in 37 states and the District of Columbia, and some of these states levy a tax on the purchase. However, state tax rates on medical marijuana are relatively low and obstacles (e.g., doctor appointment, application fee) limit its consumption. As a result, states do not raise much revenue from these taxes.

What are the different types of cannabis taxes?

There are three main ways state and local governments tax recreational marijuana.

Percentage-of-price. A percentage-of-price cannabis tax typically works like a general sales tax in that the tax is calculated as a percentage of the retail price, is paid by consumers in addition to their purchase at checkout, and is remitted to the government by the retailer. However, like other excise taxes, a cannabis tax rate is typically higher than the government’s general sales tax rate. State cannabis tax rates range from 6 percent in Missouri to 37 percent in Washington. Local cannabis taxes are typically capped by the state and set between 2 percent and 5 percent. The percentage-of-price tax is the most popular tax on cannabis. Counting states that have passed marijuana tax legislation but not begun legal sales, 16 states solely use this type of tax and five states use it in addition to another tax.

Weight-based. Alaska, Colorado, Maine, Nevada, and New Jersey use a weight-based cannabis tax. Tax calculations vary across these states, but in every state the cultivator (i.e., cannabis grower) is responsible for remitting the tax to the government, and in every state but New Jersey different parts of the plant are taxed at different rates (e.g., flower is taxed at the highest rate because it is the most potent part).

Potency-based. A potency-based tax is calculated based on the cannabis product’s level of tetrahydrocannabinol (THC), the primary psychoactive compound in cannabis. This type of tax roughly mirrors state alcohol taxes where higher tax rates are applied to products containing a higher concentration of alcohol (i.e., a state’s per gallon alcohol tax rate is higher on liquor than wine and higher on wine than beer). Connecticut, Illinois, and New York use THC in their tax calculations.

Additionally, state or local governments in 18 states levy their general sales tax on the purchase of marijuana in addition to their excise taxes.

For a detailed description of these taxes, plus an analysis of the pros and cons of each type of cannabis tax, see the Tax Policy Center's 2022 report, "The Pros and Cons of Cannabis Taxes."

What is each state's cannabis tax system for 2023?

Alaska: The state’s weight-based tax is collected on the first sale of cannabis from a licensed cultivator to a product manufacturing facility or retail store. Alaska uses different rates for different parts of the plant, including a $50-per-ounce tax on flower. Local governments can also levy an excise tax on cannabis—some levy a percentage-of-price tax and others levy a weight-based tax. Legal sales began in October 2016.

Arizona: The state levies a 16 percent excise tax on cannabis sales that is paid by consumers and remitted by retailers. There are no local cannabis taxes in Arizona. Legal sales began in January 2021.

California: The state levies a 15 percent excise tax on cannabis sales that is paid by consumers and remitted by retailers. California’ state government previously also levied a weight-based tax, but that tax was repealed in 2022. Local governments in California can also levy an excise tax on cannabis businesses. Some local governments tax a cannabis business on the square footage of its commercial cannabis operations while others levy a gross receipts tax. The latter tax can be applied on the cultivator, distributor, and the retailer, which means the tax burden on the customer is possibly well above the listed tax rate. Legal sales began in January 2018.

Colorado: The state levies both a 15 percent excise tax on cannabis sales (paid by consumers and remitted by retailers) and a weight-based tax (paid and remitted by cultivators). For the weight-based tax, a cultivator’s crop is weighed, multiplied by the “retail marijuana average market rate” price (an average price set by the government), and then that product is multiped by a 15 percent tax rate. There are no local cannabis taxes in Colorado. Legal sales began in January 2014.

Connecticut: The state’s potency-based tax is a per-unit tax paid by consumers and remitted by retailers. For cannabis plant material the tax is 0.625 cents per milligram of THC, for edibles the tax is 2.75 cents per milligram of THC, and for all other products the tax is 0.9 cents per milligram of THC. Local governments can levy a 3 percent retail tax on cannabis sales. Legal sales began in January 2023.

Delaware: Legislation legalizing marijuana possession and establishing a 15 percent excise tax on the purchase price of cannabis became law in April 2023. As of November 2023, legal cannabis sales had not yet begun in Delaware.

Illinois: The state levies a 7 percent excise tax on cultivators’ gross receipts (cannabis cultivation privilege tax) and a potency-based tax on retail sales (cannabis purchaser excise tax). The cultivation privilege tax is applied on the cultivator’s first sale while the purchaser excise tax is collected and remitted by the retailer. The potency-based tax is determined by the level of THC in the product and levied as a percent of the retail sale price. Products with a THC level under 35 percent are taxed at 10 percent of the retail price and products with THC levels above 35 percent are taxed at 25 percent. All cannabis-infused products (e.g., edibles) are taxed at 20 percent of retail price. Local governments can also levy a percentage-of-price excise tax on cannabis. The local tax rate is capped at 3 percent for municipalities and 3.75 percent for counties. However, the county tax is capped at 3 percent when there is also a municipal tax on the purchase. For example, both the city of Chicago and Cook County levy the maximum tax rate, so customers in Chicago pay a 6 percent local excise tax on their purchase. Legal cannabis sales began in January 2020.

Maine: The state levies both a 10 percent excise tax on cannabis sales (paid by consumers and remitted by retailer) and a weight-based tax (paid and remitted by cultivators). Maine uses different rates for different parts of the plant, including a $335-per-pound tax on flower. There are no local cannabis excise taxes in Maine. Legal sales began in October 2018 but the state did not begin collecting cannabis tax revenue until November 2020.

Maryland: The state levies a 9 percent excise tax on the retail price. There are no local cannabis excise taxes in Maryland. Legal cannabis sales began in July 2023.

Massachusetts: The state levies a 10.75 percent excise tax on cannabis sales that is paid by consumers and remitted by retailers. Local governments are also allowed to levy up to a 3 percent tax on the retail price. Legal sales began in November 2018.

Michigan: The state levies a 10 percent excise tax on cannabis sales that is paid by consumers and remitted by retailers. There are no local cannabis excise taxes in Michigan. Legal sales began in December 2019.

Minnesota: Legislation legalizing marijuana possession and establishing a 10 percent excise tax on the purchase price of cannabis became law in May 2023. There are no local cannabis excise taxes in Minnesota. As of November 2023, legal cannabis sales had not yet begun in Minnesota

Missouri: Missouri voters approved recreational cannabis in November 2022. The ballot measure included a 6 percent excise tax on cannabis sales that is paid by consumers and remitted by retailers. Local governments are also allowed to levy up to a 3 percent retail tax. Legal sales began in February 2023.

Montana: The state levies a 20 percent excise tax on cannabis sales that is paid by consumers and remitted by retailers. Local governments are also allowed to levy up to a 3 percent tax on the retail price. Legal sales began in January 2022.

Nevada: The state levies both a 10 percent excise tax on cannabis sales (paid by consumers and remitted by retailers) and a weight-based tax (paid and remitted by cultivators). To calculate the weight-based tax, a cultivator’s crop is weighed, multiplied by the “fair market value at wholesale” price (an average price set by the government), and then that product is multiped by the 15 percent tax rate. There are no local cannabis taxes in Nevada. Legal sales began in July 2017.

New Jersey: The state’s weight-based tax is collected by cultivators. New Jersey uses one tax rate for all parts of the plant. The rate is currently $1.10 per ounce, but the state can update the rate based on the average retail price of cannabis in New Jersey. Local governments can also levy a 2 percent gross receipts tax on cannabis businesses. Because this tax is levied on multiple businesses in the supply chain (cultivator, distributor, and retailer), the tax burden can “pyramid” so that the actual tax paid by the consumer is higher than the listed 2 percent rate. Legal sales began in April 2022.

New Mexico: The state levies a 12 percent excise tax on cannabis sales that is paid by consumers and remitted by retailers. There are no local cannabis excise taxes in New Mexico. Legal sales began in April 2022.

New York: There is both a 13 percent excise tax (9 percent state and 4 percent local) on cannabis sales (paid by consumers and remitted by retailer) and a potency-based tax (remitted by distributors) in New York. The potency-based tax is a per unit tax: 0.5 cents per milligram of THC in flower products, 0.8 cents per milligram of THC in concentrates, and 3 cents per milligram of THC in edibles. Legal sales began in December 2022.

Ohio: Voters approved legal marijuana and a 10 percent excise tax on the purchase price of cannabis in November 2023. There are no local cannabis excise taxes in Ohio. As of November 2023, legal cannabis sales had not yet begun in Ohio

Oregon: The state levies a 17 percent excise tax on cannabis sales that is paid by consumers and remitted by retailers. Local governments are also allowed to levy up to a 3 percent tax on the retail price. Legal sales began in October 2015.

Rhode Island: The state levies a 10 percent excise tax on cannabis sales that is paid by consumers and remitted by retailers. Local governments are also allowed to levy up to a 3 percent tax on the retail price. Legal sales began in November 2022.

Vermont: The state levies a 14 percent excise tax on cannabis sales that is paid by consumers and remitted by retailers. There are no local cannabis taxes in Vermont. Legal sales began in October 2022.

Virginia: The state enacted a 21 percent excise tax on cannabis sales that is paid by consumers and remitted by retailers. Local governments will also be allowed to levy up to a 3 percent tax on the retail price. As of November 2023, legal cannabis sales had not yet begun in Virginia.

Washington: The state levies a 37 percent excise tax on cannabis sales that is paid by consumers and remitted by retailers. There are no local cannabis taxes in Washington. Legal sales began in July 2014.

How do states use cannabis tax revenue?

Most states that tax cannabis dedicate at least a share of the resulting revenue to specific spending programs.

Ballot measures proposing legalization and taxation often include language about how the resulting funds will be spent to appeal to voters who otherwise might be wary of allowing legal sales of marijuana. Legislators pushing cannabis legislation also often dictate how the revenue will be spent for similar purposes.

Some states dedicate cannabis tax revenue to traditional government programs. For example, Arizona spends one-third of its revenue on community colleges, Colorado spends all of its revenue on public school construction, Michigan uses a majority of its revenue for K-12 public schools and road repair and maintenance, and Washington spends half of its revenue on health care programs.

But increasingly states are using revenue from taxes on marijuana to address costs related to the government’s past enforcement of drug laws. For example, Illinois, Massachusetts, New Jersey, and New York all dedicate a portion of their cannabis tax revenue to programs that support economic and workforce development in communities disproportionally harmed by previous drug laws and enforcement.

Some states also dedicate revenue to government programs that can address marijuana’s negative externalities. Cannabis has known negative effects (including impaired decision-making and addiction) and documented benefits (alleviating chronic pain and mitigating various diseases). Alaska, California, Illinois, Montana, New York, Oregon, and Washington use a portion of their cannabis tax revenue to fund programs for substance abuse and drug education and prevention.

For a detailed description of how each state spends its cannabis tax revenue, see the Tax Policy Center's 2022 report, "The Pros and Cons of Cannabis Taxes."

Further reading

The Pros and Cons of Cannabis Taxes

Richard Auxier and Nikhita Airi (2022)

Cannabis Taxes on the Ballot: Voters Approve, Legislatures Change

Richard Auxier (2022)

Critical Value Podcast: #46 Sin Taxes Are Sweeping the States!

Richard Auxier and Lucy Dadayan (2020)

Why Do States Tax Illegal Drugs?

Nikhita Airi and Aravind Boddupalli (2020)

Should We Tax Internalities Like Externalities?

Donald Marron (2015)

How Should Governments Use Revenue from Corrective Taxes?

Adele C. Morris and Donald Marron (2016)