Baby boomers and those in the silent generation, now in their 60s, are more likely to have medical problems than younger generations. Are they also more likely to have past-due medical debt? Our colleagues’ recent analysis found this is not the case.

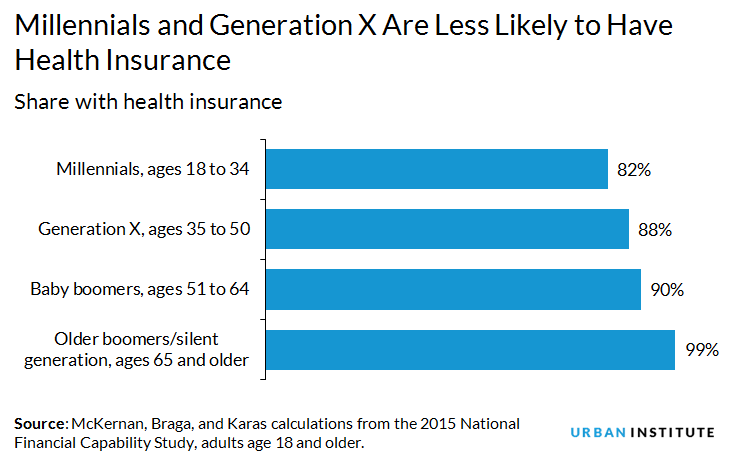

About one in five adults in America have past-due medical bills, and that number rises to about one in four when focusing on adults under age 65. About 25 percent of millennials and gen Xers (ages 18 to 50) have past due medical debt, while 20 percent of baby boomers (ages 51 to 64) and 10 percent of people over age 65 have past-due medical debt.

Health insurance coverage is likely a key driver of medical debt, with the elderly having more protection against medical debt in part because of Medicare’s broad reach. Likewise, baby boomers have lower uninsurance rates compared with younger adults who are millennials or gen Xers, which may contribute to their lower rates of past-due medical debt.

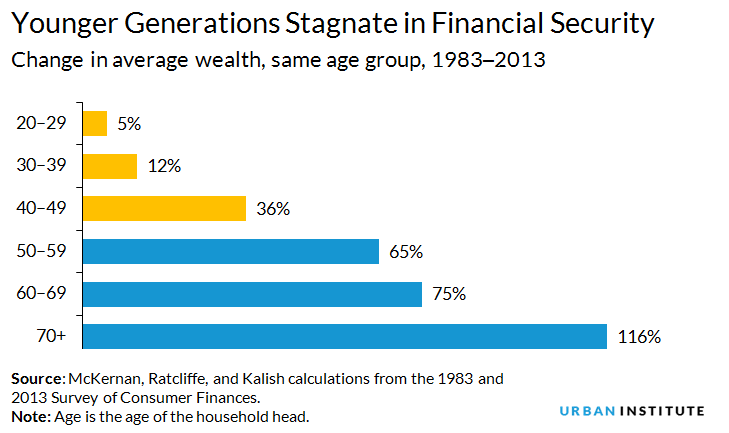

That millennials and generation X are more likely to have past-due medical debt is consistent with what we know about wealth. Americans often assume that every generation will fare better than the previous generation, but these assumptions run contrary to reality for today’s young adults.

When comparing wealth in 2013 with that of people the same age 30 years earlier, people under 40 are stagnating in wealth accumulation. Younger generations are barely breaking even with the wealth people their parents’ age had in the 1980s. People in the baby boomer and silent generations have more wealth on average than people at their age 30 years ago.

Wealth isn’t just for the wealthy. Wealth provides a soft landing in case of emergency (like an unplanned trip to the hospital), tuition to get a better education and a better job, and capital to build a small business. Wealth is where economic opportunity lies.

What can we do about past-due medical debt?

Financial knowledge may help adults avoid accumulating past-due debt. Adults with greater financial knowledge are less likely to have past-due medical debt, even after controlling for health insurance status, disability status, income, and other demographic and socioeconomic measures.

We should also work toward a future in which all Americans have health insurance. Adults with health insurance are less likely to have past-due medical debt , even after controlling for observed levels of financial knowledge, disability status, income, and other demographic and socioeconomic measures. Similarly, earlier studies found that Medicaid coverage of low-income adults in Oregon reduced the likelihood of borrowing money or skipping bills to pay for medical care, and that Medicaid expansion under the Affordable Care Act (ACA) improved low-income adults’ financial well-being.

Future exposure to medical debt for millennials and gen Xers will likely depend on whether the ACA is repealed and what type of replacement is enacted. The number of uninsured adults ages 18 to 34 would increase by just over 11 million if the ACA were repealed through budget reconciliation, which would likely put more young adults at risk of experiencing medical debt.

Having past-due medical debt creates difficulties for today and the future. Past-due medical debt can lower your credit score, affecting future access to credit (such as getting a mortgage or borrowing for a small business) and the price of credit. Credit report information can be used to determine eligibility for jobs, access to rental housing, and insurance premiums.

The financial uncertainty faced by our youngest generations should be everyone’s concern as we seek to ensure all Americans have an equal opportunity to succeed.

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.