Veterans are taking out more and more mortgages through the US Department of Veterans Affairs’ (VA) mortgage insurance program. The VA’s share of the government-insured market has increased substantially. Most of this growth has come through the nonbank origination channel. Although welcome, this development has increased the VA’s risk exposure to thinly regulated nonbank financial institutions. This is another reason why policymakers must enhance nonbank regulation.

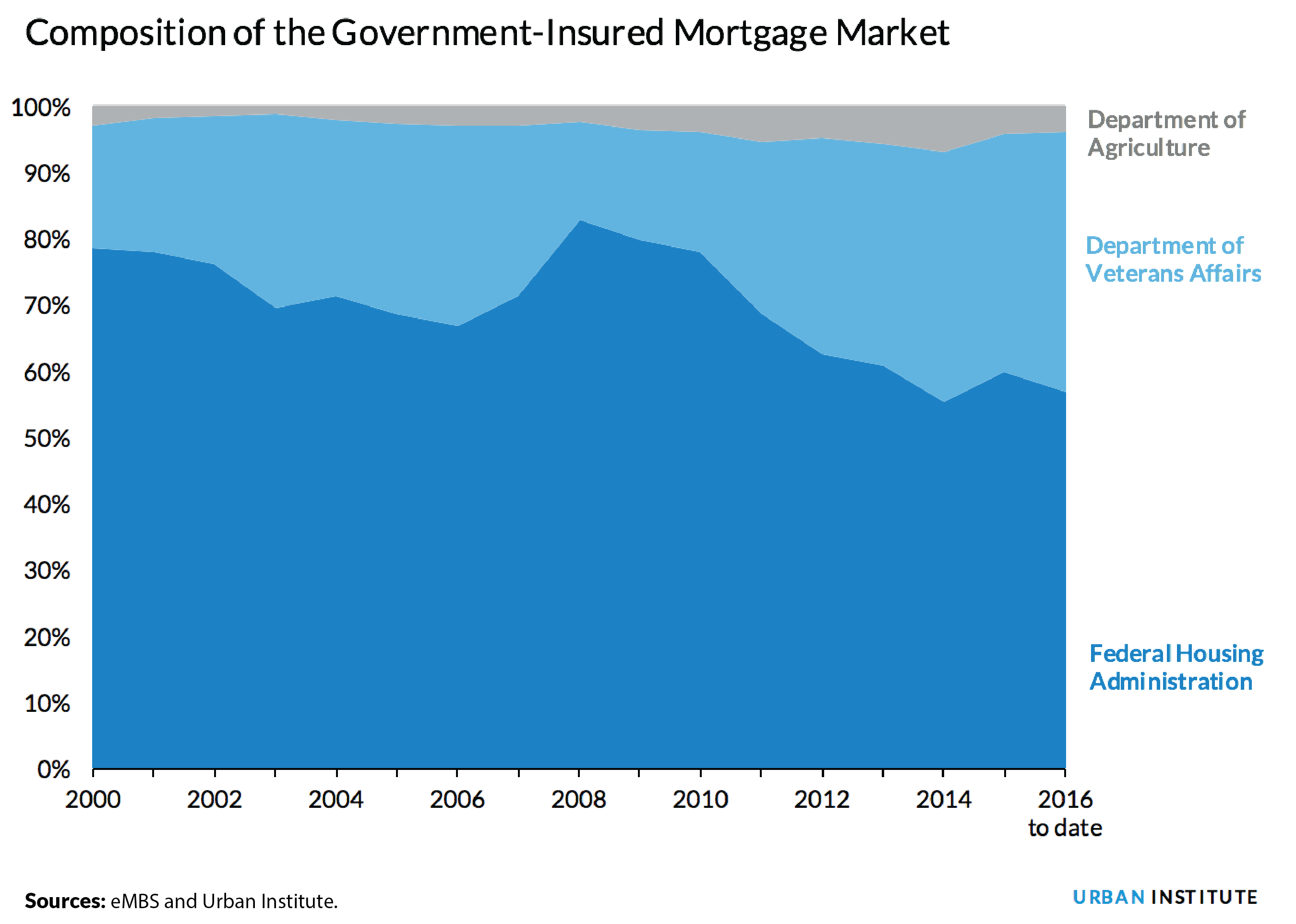

Between 2009 and 2015, the total annual volume of VA mortgage originations more than doubled from $75 to $155 billion. More importantly, the VA has become a much bigger player in the government-insured market, which includes the Federal Housing Administration (FHA) and the US Department of Agriculture (USDA). The VA’s share has increased from just 17 percent of a $450 billion market in 2009 to 36 percent of a $436 billion market in 2015. Most of this increase has come through the thinly regulated nonbank lending channel, as many large depository institutions have pulled back from the market. Nearly 7 in 10 VA mortgages are being originated through the nonbank channel today.

This trend highlights the need to regulate nonbank lenders. Unlike the FHA, which backs its loans 100 percent, the VA only covers the first 25 percent of the loans it insures. If a loan defaults, the lender has to take the loss on the remaining 75 percent of the loan balance. If the lender cannot fulfill this financial obligation, the VA—and hence, taxpayers—pick up the tab.

This risk is much lower for depository originators because they are subject to stringent capital requirements. But nonbank lenders are subject to much lower capital and liquidity standards. Their increasing role in VA originations increases the likelihood they may not be able to fulfill their financial obligations to the VA in times of economic stress.

VA loans can also limit upside for Ginnie Mae securities investors because VA mortgages tend to refinance at much faster rates than FHA mortgages.

In 2016, 50 to 60 percent of total VA originations have been refinances, compared with 30 to 35 percent of FHA mortgages. VA borrowers have higher credit scores and lower debt-to-income ratios relative to FHA borrowers. This allows VA borrowers to more easily qualify for refinancing. Veterans also have access to an efficient VA refinance program that requires no appraisal, no underwriting, and no out-of-pocket expenses. VA borrowers also tend to have higher loan balances than FHA borrowers and stand to save more by refinancing, even if rates fall only slightly.

Because VA and FHA loans get bundled together into Ginnie Mae mortgage-backed securities, the growing share of VA loans causes the securities to prepay sooner. This could limit upside for investors as interest rates fall, because the prepaid funds must be reinvested at a lower rate.

To be clear, the increase in VA lending volumes and the growth of nonbanks are positive developments that allow veterans to obtain mortgages on more favorable terms and help expand credit to nonpristine borrowers in an otherwise tight lending environment. More importantly, this growth has transformed the VA into a much bigger player. But that transformation has implications for the broader mortgage market. One of those implications is for Ginnie Mae’s security investors; the other is that the VA is now more exposed to nonbanks than before. And given the thin capital and liquidity requirements under which nonbanks operate, it is important to address this risk.

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.