For the first time since 2009, the number of borrowers actively paying reduced mortgages through the Treasury Department’s Home Affordable Modification Program (HAMP) declined in the fourth quarter of 2015 (Q4 2015). This suggests market improvements, but the uneven recovery has left many borrowers in distress. We must continue to monitor these distressed borrowers as these modified mortgages experience interest rate resets in the coming months.

Decline in HAMP active permanent modifications

As of the end of 2015, there were about 980,000 “active” permanent HAMP modifications in the United States—that is, modifications that had moved from trial to permanent and had not become inactive by being paid off, withdrawn, or disqualified. Nationally, there have been 7.8 million mortgage modifications since Q3 2007.

Most of these were modified outside the HAMP program (proprietary mods)—only 1.57 million were HAMP—but many of the proprietary mods use HAMP as a blueprint. Accordingly, HAMP trends are important indicators for other active mortgages modifications.

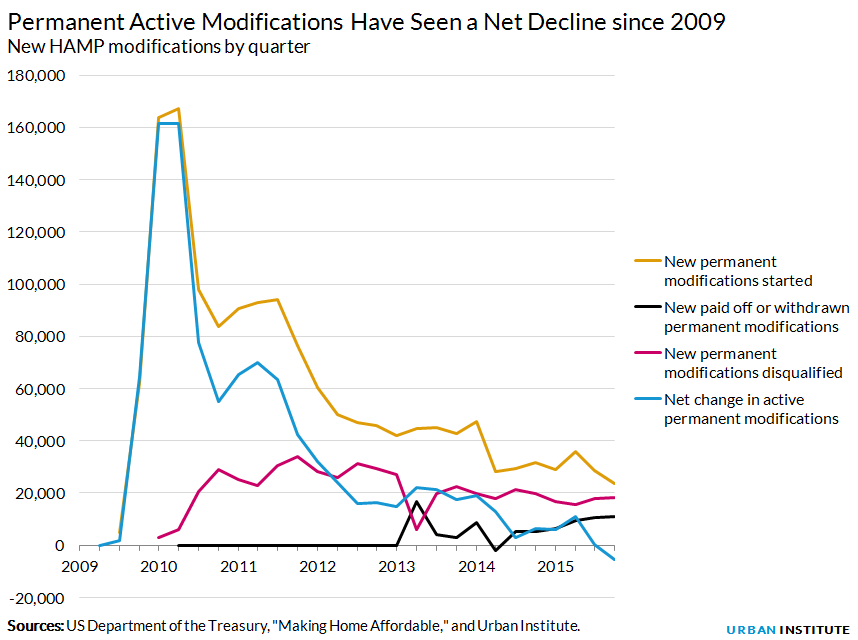

In Q4 2015, the number of active permanent modifications declined (for the first time ever) by 5,408 mortgages. Two factors are behind the change (figure 2):

- Fewer new modifications were made

- More active modifications became inactive because of borrowers paying off their permanent modifications and borrowers withdrawing or becoming disqualified by failing to pay the modified mortgage; approximately 15,000 to 20,000 permanent modifications withdraw or become disqualified each quarter

The decline in new modifications and the increase in borrowers paying off their modified mortgages remind us that, in some ways, the financial crisis is behind us. The housing market is improving, and relatively few new mortgages are delinquent. Many formerly underwater borrowers can now use equity to sell their homes and pay off their mortgage or refinance.

But the continued failed modifications reveal an uneven recovery, with some borrowers still unable to make even the reduced payment amount.

National indicators suggest that fewer active modifications will be the new normal: While the recently streamlined HAMP process may temporarily increase the number of new active modifications, that number is likely to fall in the long run as delinquency rates decline. Only 3.4 percent of loans are seriously delinquent or in foreclosure, down from a peak of close to 10 percent in 2009. And new delinquencies are at very low levels, largely because of the recovery in home prices.

Borrowers are likely to continue paying off their modified mortgages as well, given that home prices are up 37.4 percent since the trough, only 7.0 percent shy of peak levels. Only 8.5 percent of borrowers had negative equity in Q5 2014, down from over 25.0 percent in late 2011. Almost 11,000 modifications were paid off in Q4 2015, more than double the same quarter the previous year.

But many areas haven’t fully recovered: The number of additional failed modifications each quarter has stayed within a safe range, but it has not declined in tandem with housing market improvements. The uneven recovery means that house prices are above precrisis levels in only four of the top 15 metropolitan statistical areas. Prices remain more than 30 percent below their precrisis peak in Riverside, California, and Phoenix, Arizona, and in many of these communities, incomes have also failed to recover. Stagnant incomes and house prices in some areas mean that many borrowers will continue to have difficulty paying even modified mortgages.

Many borrowers face interest rate resets after the five-year period: For most loans modified under HAMP, the reduced mortgage rate remains in place for five years. After that, it increases by 1 percent per year until the rate reaches the market rate at the time of the modification. We predicted previously that rate resets would cause some additional but manageable defaults, particularly on second and third resets. The number of failed modifications includes defaults that resulted from interest rate increases. We have not seen a significant pickup in defaults, but we will continue to monitor this. We predicted that the first sizeable defaults would occur in 2016, when the 2011 cohort first resets and the 2010 and 2009 cohorts have their second and third resets. We expect the number of resets (and defaults) to increase into 2017, and then taper off (figure 3).

The Treasury offers a $5,000 principal reduction for HAMP borrowers who have made their modified payments for six years in hopes of decreasing defaults, in addition to other measures. But in the absence of additional formal programs to address the interest rate increases, we expect few repeat modifications for borrowers who cannot make the increased payment that comes with the resets.

While the first-ever decline in active permanent HAMP modifications is an expected and positive outcome of the housing recovery, we will continue to monitor the 15,000 to 20,000 failed HAMP modifications that happen each quarter. If the number of failed modifications increases (an unlikely scenario), Treasury may need to consider a more formal mechanism for dealing with repeat modifications as interest rates reset.

HAMP is set to expire by the end of this year and will not accept new applications. Continued monitoring of existing HAMP modifications, however, will give us a good indication of what to expect with the larger body of loans that were modified under proprietary programs patterned after HAMP.

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.