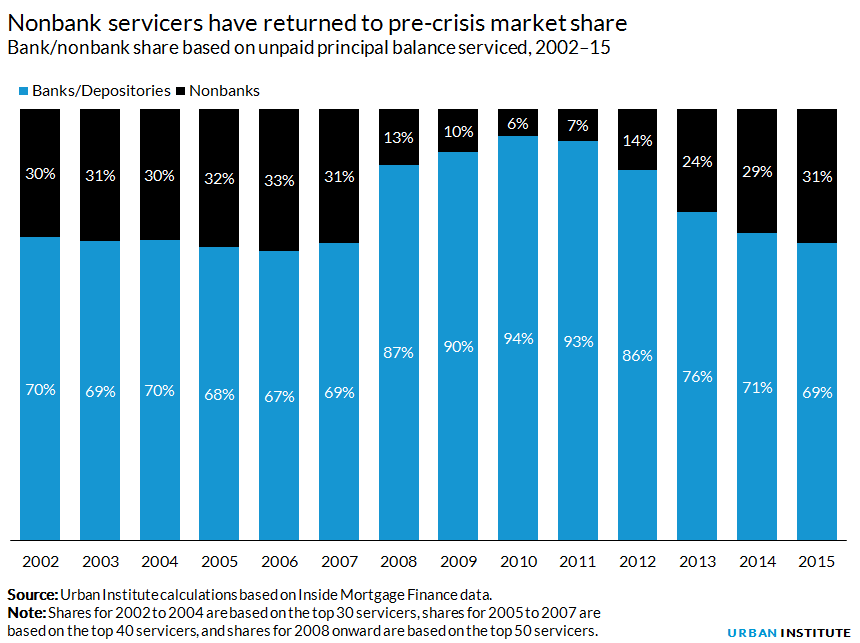

Mortgage servicing is the real grunt work of mortgage lending: the servicer collects monthly payments from borrowers, pays investors, and works with borrowers to resolve payment problems. Traditionally, depository banks dominated the servicing space, owning about 70 percent of the market share. Nonbank institutions, which don’t take consumer deposits, accounted for the remaining 30 percent up until 2007 before shrinking to 6 percent by 2010, as the bank market share grew. But since then, the split between banks and nonbanks has returned to the pre-crisis level of 70/30 percent as nonbanks have regained lost share. This recent retreat of banks is partly driven by post-crisis financial reforms that have focused much more on banks and less on nonbanks even though both were under-regulated and under-capitalized before the crisis. Government agencies have recently ramped up nonbank regulation somewhat, but not enough to ensure that taxpayers are adequately protected.

Nonbank servicers face unique risks

Depository institutions have witnessed a significant tightening of their regulatory environment post-crisis. Nonbank regulation also, to some extent, has improved by way of new capital, liquidity, and net worth requirements. While these requirements may suffice in the present low-risk and stable interest rate environment, they will not be adequate if defaults rise or interest rates become volatile. Nonbanks are more vulnerable under these scenarios for a few reasons:

- Nonbanks are heavily exposed to mortgage-servicing rights (MSRs), a highly volatile asset class. Our analysis of the largest public banks and nonbanks revealed that MSRs constituted less than 1 percent of each bank’s total assets but as much as 10 to 35 percent of each nonbank’s total assets.

- Unlike many other financial instruments, MSRs are not actively traded in an open liquid market. Instead, as a hard-to-value asset, MSR pricing is significantly model-dependent and prone to assumptions, which creates additional price volatility.

- The requirement to remit payment to investors, even for mortgages in default, can cause significant liquidity crunch if delinquencies begin to rise rapidly.

To protect against these risks, the GSEs and Ginnie Mae have issued new minimum capital and liquidity requirements for servicers of their mortgages. But we have three concerns:

- These requirements are not risk based: they don’t require nonbanks to hold more capital against greater risks, instead leaving it to management judgment.

- Existing regulation, especially in case of Ginnie Mae, relies more on ongoing monitoring to sniff out early signs of trouble. While we support this approach, a major shortcoming is that financial distress can often set in quickly and unpredictably, leaving little or no time for remedial action.

- When a nonbank servicer becomes insolvent, regulators often respond by transferring loan servicing to another financially sound servicer. Because this usually happens under panic, finding a buyer quickly and maximizing sale proceeds are often much higher priorities than ensuring the quality of servicing for borrowers.

- Perhaps most importantly, if there is not enough buyer interest in acquiring a for-sale servicing portfolio, or bid prices are low, Ginnie Mae and the GSEs may have to pay the new servicer to pick up the loans, putting taxpayers at risk.

In short, the risks, costs, and disruptions associated with the failure of a nonbank servicer are borne largely by borrowers, government agencies, and ultimately the taxpayers. Bolstering nonbank capital requirements would effectively pass on some of this cost to the industry and reduce the risk posed to other entities. We urge the GSEs and Ginnie Mae to revisit this topic to strike a healthier balance between nonbank capital requirements and ensuring a well-functioning industry that works for borrowers, investors and taxpayers, in both good times and bad.

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.