Homebuyers in San Francisco are willing to take on over twice as much monthly debt, relative to income, as borrowers in Atlanta, so a listing that seems affordable in one city may feel too pricey in another. A new analysis by our colleagues in the Housing Finance Policy Center finds that variations among regional housing markets make a major difference in how cities stack up when it comes to affordable homeownership.

Measuring affordability

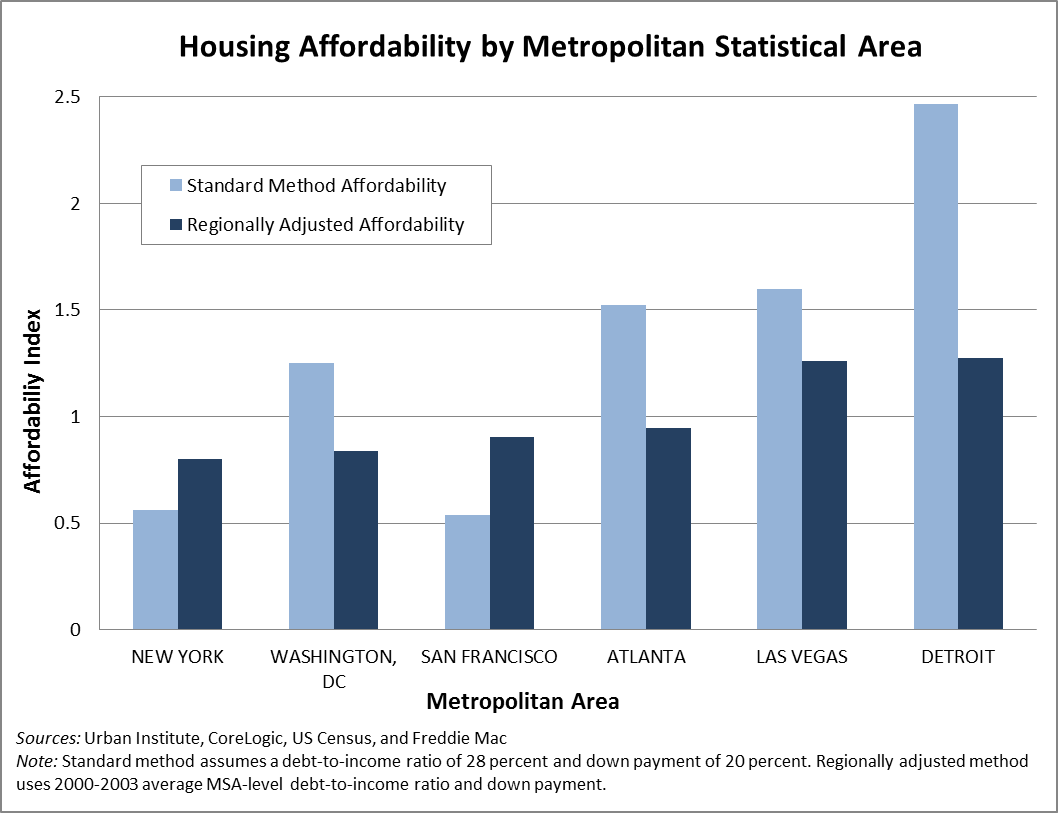

Like the National Association of Realtors’ Housing Affordability Index, we measure affordability by comparing the median house price in an area to the maximum price a median-income family can afford. If the affordable price is less than the median price, the index is less than one, indicating that the area is not affordable; if it exceeds the median price, the index is greater than one, which means homeownership is affordable at the median.

But accurately calculating the maximum affordable price is a tricky process that requires a few key assumptions. Traditional measures of affordability use a standard debt-to-income ratio of 28 percent and a down payment of 20 percent of the house price. These assumptions overlook regional differences and can lead to faulty comparisons of affordability.

Our regionally specific measure better captures differences in the amount that median-income borrowers are willing to pay for a home, and in the size of the down payment they typically make. For each of the 37 largest metro areas, our analysis uses loan-level origination data from CoreLogic to compute average debt-to-income ratios from 2000 to 2003 (a relatively stable period for housing prices) and average down payment on purchase loans in 2013.

Some metros turn out to be less affordable, some more

Not surprisingly, results from the standard measure and the regionally specific measure varied significantly, with some metros shifting far along the affordability spectrum.

Washington, D.C. is considered solidly affordable under the standard affordability measure, but the regionally adjusted measure reveals that D.C. is modestly unaffordable at the median due to its below average debt-to-income ratio of 20 percent. In other words, because D.C. borrowers are accustomed to spending less of their monthly income on mortgage payments relative to borrowers in other MSAs, the current regional housing market is substantially less affordable than the standard, fixed debt-to-income method suggests. The new analysis found that the price a median-income D.C. family can afford is nearly $90,000 less than what the standard method projected, bringing the affordability index down from 1.25 to .84.

With the new methodology, San Francisco’s affordability improved, in part because Bay Area borrowers are accustomed to larger down payments—28 percent in 2013—than other regions. But the city still remains one of the least affordable areas due to the resurgent housing market there.

Industrial, Midwest metros like Detroit and Cleveland, where prices have remained fairly low even during the housing recovery, were some of the most affordable regions under the regional measure.

Refining measures of housing affordability

The Housing Finance Policy Center will continue to study the nuances of housing affordability, especially for low-income households. Replicating the index at lower incomes and adjusting other borrower and loan characteristics (in particular, funds available for a down payment) would yield a more relevant measure for distressed households, and could significantly alter the order of metros by affordability. In the meantime, we will continue to publish our updated and improved affordability analyses in our monthly chartbook.

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.