Several concrete signs lately point to a broad-based housing recovery across the nation: Home sales are increasing, prices are rising, credit access is gradually easing and private capital is slowly coming back. But not everything is back to normal: credit availability is still very tight, delinquencies are still elevated and taxpayers still back the overwhelming majority of the mortgage market. With such contradictions and no single indicator of market health, how will we know when the market has recovered enough?

In 2001, home prices were rising moderately, mortgage credit was easier to obtain (but by no means loose), underwriting was sound, private capital was abundant and default and foreclosure rates were low. This was a healthy housing market, but how does today’s market compare?

-

The government has a much larger share of the market. In 2001, the Federal Housing Administration, Department of Veterans Affairs, and the government sponsored enterprises together backed about 52 percent of all first-lien mortgage originations while private capital financed the remainder. In 2014, the government-backed share was 71 percent after peaking at nearly 90 percent in 2009. Obviously we have come a long way from 2009, but the government share is still too high and unsustainable.

-

It’s much harder to qualify for a mortgage. The Housing Finance Policy Center’s Housing Credit Availability Index measures the expected default risk of all mortgages originated in a given year – a measure that precisely reveals how hard it is for borrowers to qualify for a mortgage. The default risk of mortgages originated in 2001 (and from 2000 to 2003 in general) was about 12.5 percent. As the housing bubble began inflating along with riskier lending, the expected default risk increased to nearly 17 percent. Post-crisis however, as lenders switched to originating only the safest mortgages, the expected default risk fell rapidly to just 4.6 percent in 2013. Access to credit has since started to improve slowly with default risk increasing to 5.7 percent in early 2015. While this level is encouraging, it’s less than half of the risk the mortgage market took in 2001. Indeed, today’s lending environment continues to remain extremely tight compared to the cautious standards of the 2000 to 2003 period.

-

There are fewer mortgages being originated. Approximately 4.7 million first-lien purchase mortgages were originated in 2001. In contrast in 2013, the latest year for which HDMA data are available, only 3 million such mortgages were originated. Our previous research shows that a big reason for this decline is the extraordinarily tight lending standards of the post-crisis period. Specifically, the mortgage market would have made an additional 1.2 million loans in 2013 if the cautious lending standards of 2001 had been in place.

-

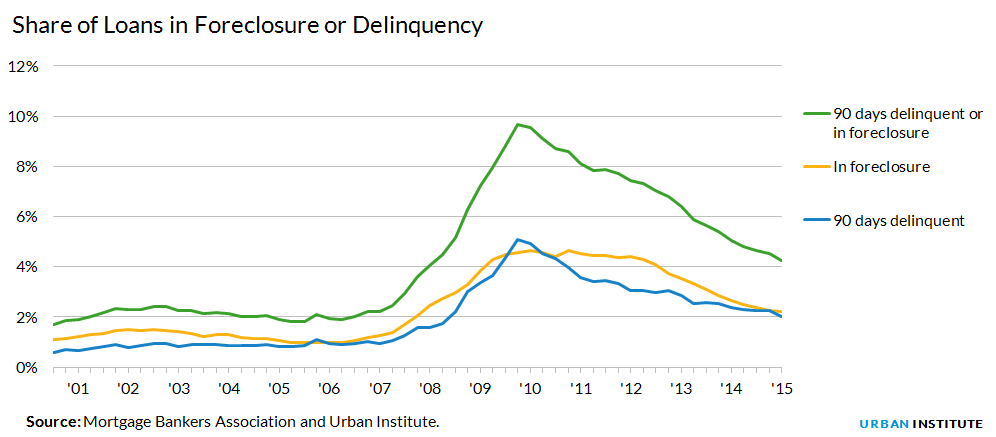

The rate of seriously delinquent mortgages is much higher. When a mortgage remains unpaid for more than 90 days or goes into foreclosure, it is considered seriously delinquent. Although the rate of seriously delinquent mortgages has declined recently as house prices have recovered, it still remains high relative to 2001. Loans that are more than 90-days delinquent or in foreclosure comprised 4.2 percent of all outstanding mortgages in the first quarter of 2015, down from nearly 10 percent in 2009, but still elevated from 2.4 percent in 2001. This reflects the hangover from the foreclosure crises, as new origination is pristine.

We continue to move in the right direction, but progress has been uneven. So how will we know when the mortgage market has recovered enough and is healthy once again? When the government share of the mortgage market is closer to 50 percent, when the expected default risk is closer to 12.5 percent, when first-lien mortgage originations are closer to 5 million, and when the rate of seriously delinquent mortgages is closer to 2.4 percent. In other words, when it looks more like 2001.

Review more charts and data about the housing market in our July Chartbook or subscribe to the bi-weekly Housing Finance Policy Center newsletter.

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.