In the decade preceding the Great Recession, I was monitoring housing market trends in the Washington, DC metro area. The region’s economy was booming, population was expanding, and house prices were sky-rocketing. Well-educated people could get great jobs with high pay. But people working low- and medium-wage jobs had a tough time finding affordable homes and apartments. Even so, Washington seemed like a good place to live: unemployment was low and earnings were well above the national average – even for jobs at the bottom of the wage ladder.

Recently, the Occupy Wall Street protests have made me wonder whether the most prosperous metros – New York, DC, and San Francisco, for example – are really good places for the 99% to live. Despite the crash, housing prices and rents there remain high. Skilled professionals can probably earn enough to cover housing costs (if they can find work), but lower skilled workers face a real pinch.

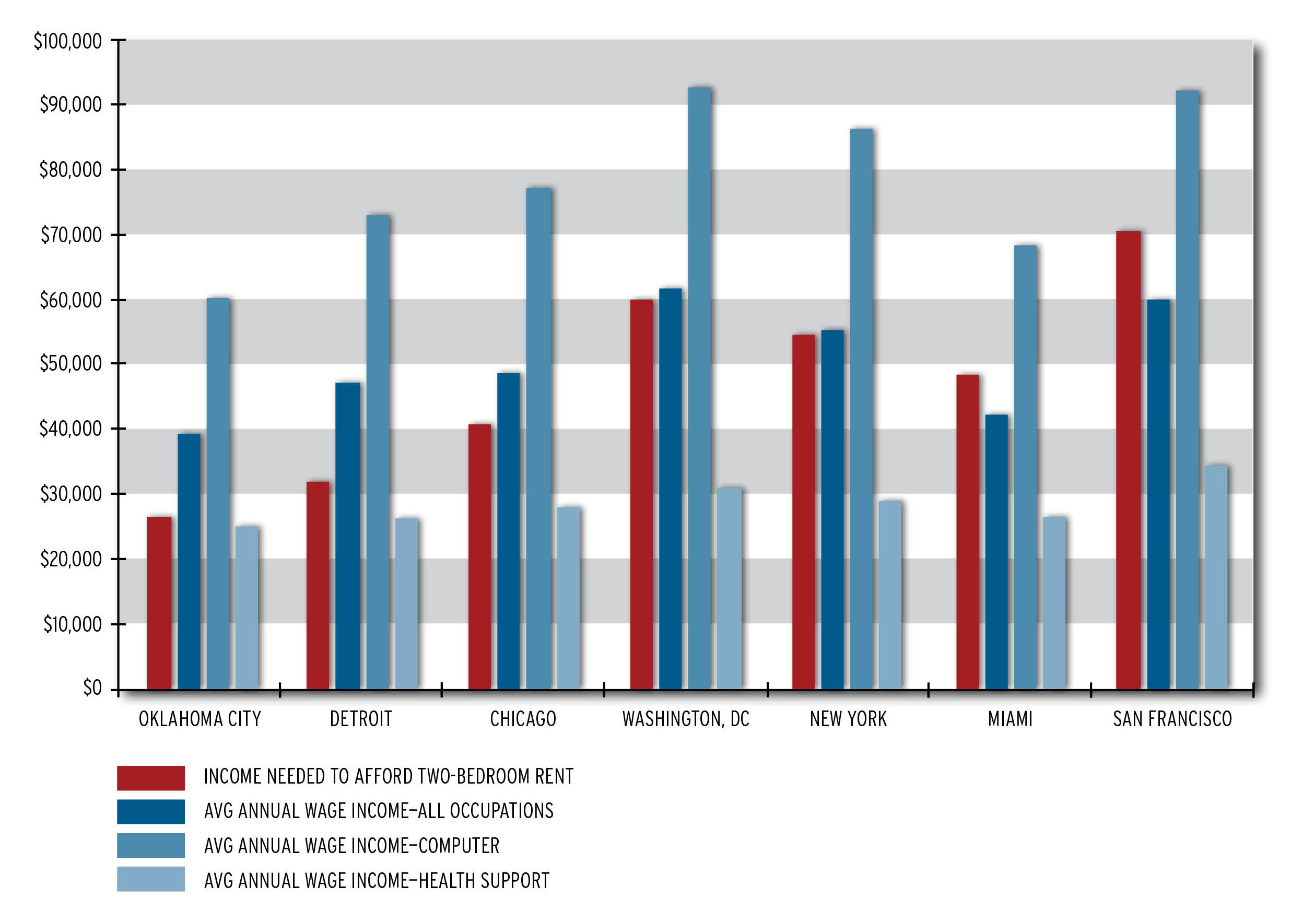

Take a look at a few numbers. If you live in the DC metro, you need to earn about $60,000 to afford the rent for a typical (modest) two-bedroom apartment. Average earnings just barely exceed that threshold. If you’re a computer professional, you probably earn much more (over $90,000 on average), but if you’re a personal service worker, you may only earn half of what you need to afford that apartment. Disparities are equally stark in San Francisco, but the unemployment rate there is almost 10 percent, compared to only 6 percent in the Washington region.

Who Earns Enough to Pay for Decent Housing?

Source: Urban Institute analysis of NLIHC and OES data, available from www.metrotrends.org

How do things look in a low-cost metro like Detroit? That two-bedroom apartment costs far less, but the personal service worker still can’t afford it. And the Detroit metro’s unemployment rate stands at 13 percent.

One region that looks good on these metrics is Oklahoma City. Somehow, it avoided the excesses of the boom years, and its economy has weathered the downturn better than most. Housing costs are low, and though wages are too, a personal service worker can almost afford the rent for a two-bedroom apartment. And at 5 percent, Oklahoma City’s unemployment rate is among the lowest in the country.

What can we learn from the Oklahoma City metro about keeping wages and housing costs in better balance through both good times and bad? For my next blog, I’ll track down some possible answers.

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.