In one of its final acts of 2014, Congress reduced the maximum size of mortgages guaranteed by the Veterans Administration (VA) to the size allowed for those guaranteed by Fannie Mae and Freddie Mac (GSEs). This change will begin on January 1, 2015 and affect 82 counties, especially the DC suburbs, reducing the VA loan limit by as much as 40 percent in some areas. Nevertheless, our analysis shows it will not significantly reduce credit access to the tens of millions of veterans, active members of the military, and select members of the National Guard and reserves who will be eligible for VA mortgages in 2015.

Aligning the VA and GSE loan limits

The omnibus spending bill enacted in mid-December aligns VA and GSE mortgage loan limits, which vary by county, throughout the country. Currently, the VA is authorized to guarantee loans of more than 1 million dollars in some high-cost counties of California and Massachusetts, and up to $978,750 in New York City. But starting in 2015, the VA loan limits will match the GSE’s with a $625,500 maximum loan for single-family homes in the lower 48 states. Accordingly, areas with a VA loan limit over $1 million dollars will see a reduction in the maximum-allowed loan size of more than 40 percent. Loan limits in the New York City area will fall by 36.1 percent and the Washington DC metro area will see a 9.7 percent decline (from $692,500 to $625,500).

A unique characteristic of VA loans is the little-to-no down payment requirement—a significant benefit for borrowers with adequate income, but limited assets. Banks, however, which keep loans above the GSE limits in their own portfolios, are generally reluctant to lend with such low down payments. Losing the VA guaranty, therefore, means that eligible borrowers with the income to pay for a bigger mortgage but little cash for a down payment will now have no place to go for a mortgage loan. Will this mean the loss of credit access for large numbers of veterans? Not according to our analysis.

The 2013 data show hardest hit areas have few VA loans and fewer still above GSE limit

We examined 2013 data from the Home Mortgage Disclosure Act (HMDA), the most recent available, for the counties where the VA limit will drop in 2015. We calculated (1) the portion of total originations that were VA-guaranteed, and (2) the portion of 2013-originated VA loans that exceeded the new 2015 VA limit but not the 2014 limit. Thus, we can evaluate the effect of the decrease in the loan limits.

We found that in most areas with a large decrease in the VA limit like New York City and high cost areas of California and Massachusetts, VA mortgages constitute a very small percentage of total new mortgages (4.8 percent was the maximum and most counties were under 1 percent). Moreover, for most of these counties, relatively few of the VA loans were over the new limit.

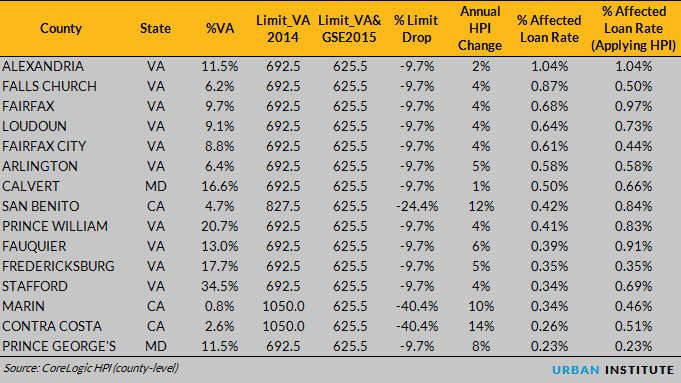

The table shows the 15 most affected areas, measured by the percent of affected borrowers. For the most impacted area, Alexandria, VA, 11.5 percent of the mortgages originated in 2013 were VA mortgages and 9 percent of these were above the 2015 limit of $625,500 but not above the 2014 limit of $692,500. Thus, 1.04 percent of the mortgages made in Alexandria in 2013 would have been affected by the change in VA loan limits or about 67 of the 6,396 loans made in the county in 2013.

Still little impact even when accounting for home price appreciation

It is reasonable to assume that 2015 mortgages would be larger than the 2013 mortgages used in this analysis by the amount of home price appreciation in the area. Using Corelogic’s county-level Home Price Index (HPI), we found that from 2013 to 2014, national house prices appreciated by about 5 percent. In the absence of better information, we assume appreciation will be the same from 2014 to 2015 as from 2013 to 2014. Note the effect of this on our calculation could be positive or negative: there could be more loans in excess of the new GSE loan limit but within the 2014 VA limit, but changes in the HPI may also push more loans over both limits. The table shows the annual HPI change, as well as the affected loan rate considering HPI. We find accounting for HPI does not significantly change the results.

Biggest impact is in the Washington metro area, particularly the Virginia suburbs

Of the 15 most affected areas, three are in California and 12 are in the Washington DC area. Of the 12 in the Washington DC area, nine are in Virginia. All of the top six are in the Virginia suburbs of Washington DC (Alexandria, Falls Church, Fairfax County, Loudoun, Fairfax City, Arlington). This is no surprise. While California, Texas, and Florida have the highest number of veterans, Virginia’s 781,000 veterans account for a larger percentage of the region’s population than those of the other states. More than one in 10 Virginia residents are veterans, while in California, less than one in 20 are veterans. Montana is the only other state within the continental United States with more than 10 percent veterans, but it is a lower cost area, so a lower percentage of VA loans are potentially above the GSE limits.

While the effect of the loan-limit change is small nationwide, it could potentially have a more noticeable impact in communities where veterans are concentrated, and where the cost of homes is relatively high. Virginia is the prime example of this; but even there, the effect is very modest.

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.