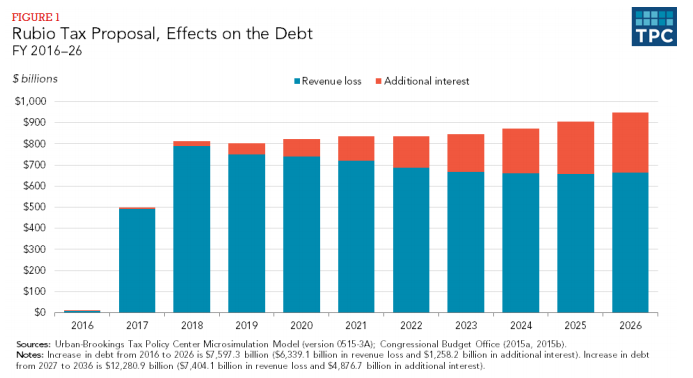

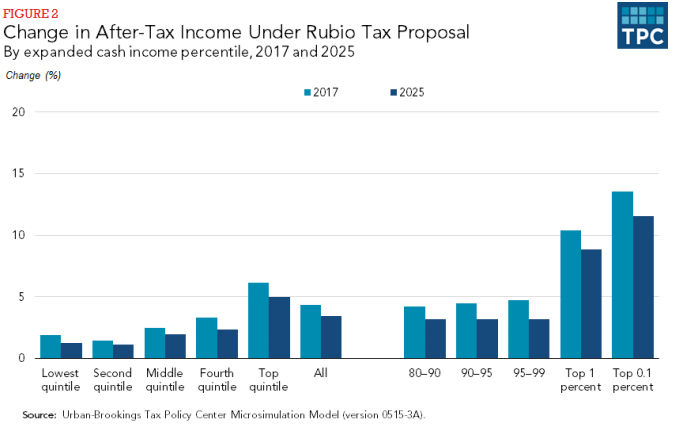

Senator Marco Rubio would convert the income tax into a progressive consumption tax, an ambitious idea that would eliminate the income tax’s penalty on saving. However, a new Tax Policy Center analysis finds that Rubio’s version would slash federal tax revenues by $6.8 trillion over the next decade with most of the benefits going to high-income households. Unless Rubio offsets those revenue losses with big spending cuts, he’d lose most if not all of the economic benefit of his plan.

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.